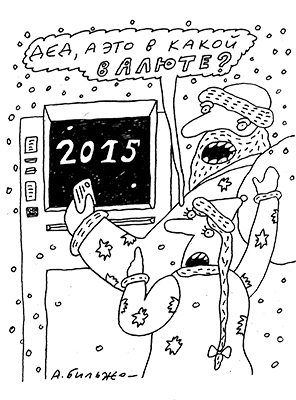

Finance

currencyTransition to the floating exchange rate sent the hryvnia into free fall

This year, the hryvnia has depreciated against the dollar by 48%. While at the beginning of 2014 the Ukrainian currency was sold on the interbank market at the rate of UAH 8.15/USD, as of December 25 the rate was UAH 15.77/USD. However, people still cannot buy foreign currency at such a rate – financial institutions have not been selling it in their cash offices for some time now. Yesterday, U.S. dollars were sold at the rate of UAH 19.15/USD on the black market. This means that the actual devaluation of the hryvnia for the year amounted to 58%.

Currency time bomb

There are numerous components and elements that affected the free fall of the hryvnia. The fundamental reasons for the devaluation are the imbalances accumulated in previous years, say representatives of the NBU. “Stability was achieved at the expense of consumption of foreign exchange reserves, which shrunk from the peak of US $38 bn in 2011 to US $15 bn in February 2014. Such devastation allowed for temporarily maintaining the stability of the hryvnia exchange rate,” said Head of the Administration of Foreign Currency Transactions and Analysis of Financial Markets at the NBU Serhiy Ponomarenko. “However, on the other hand, such an approach was in the end a time bomb that exploded in 2014,” he added.

The imbalance arose due to the fact that Ukraine imported more goods than it exported. Consequently, the current account deficit increased. “The gap between exports and imports was covered via increase of debt in foreign currency,” said Ponomarenko. This debt is mainly short-term, meaning that in the crisis period the problem of extending loans has become very acute. While Ukraine manages to defer payment of debt with the help of the International Monetary Fund (actually being forced to attract new loans to pay back previous loans), the situation in the corporate sector is much worse.

“In the corporate sector, the level of foreign debt refinancing is very low – about 75%. The fact that many are forced to pay off previous loans puts extreme pressure on the exchange rate,” says Ponomarenko. Today, devaluation has partially solved the problem – to be sure, imports have dropped. In January–October 2014 imports of goods and services decreased by almost US $21 bn, or 25% compared to the same period last year.

But the problem is that not only imports have declined, but also exports primarily to Russia have declined. Restrictions on Ukrainian goods have reduced the inflow of foreign currency to Ukraine. In 2013, 25% of Ukrainian exports were supplied to Russia. In January–September exports to Russia plummeted by US $3.3 bn, while exports to the EU increased by only US $1.3 bn. “Our western partners have done a lot to help Ukraine compensate for the losses (reduction in exports to Russia – Capital). But it takes time to reconfigure our exports to Europe. It is easy to break trade ties and it takes time to establish new relations. Over this period the receipt of proceeds to the country has sharply decreased,” the expert noted. The military conflict in the eastern regions of Ukraine and the destruction of production facilities has also had a negative impact on the local currency. In 2013, the share of the Donetsk and Luhansk oblasts in the GDP was 15% and in the share of export of goods – 25%.

Ukrainian export is suffering not only from the closure of the Russian market and the ATO. Export revenues are limited by the cost of raw materials. On world markets the prices have fallen, including the prices of goods exported by Ukraine – metal, ores, corn and wheat. These are the commodity groups which account for a significant share of our exports. “The prices of iron ore and ferrous metals, which have always been the foundation of Ukrainian exports, are rapidly falling. In 2015 exports of Ukrainian agricultural products will exceed exports of mining and metallurgy products,” predicts Head of the Analytical Department at Alfa-Bank Ukraine Oleksiy Blinov. In January–October, exports of goods and services fell by US $12 bn, or 17%. “This will always be reflected on the interbank market. In fact, revenues have significantly decreased. Unfortunately, in November we are not observing an increase,” he confirmed. In addition, the dollar becomes stronger throughout the world. As of mid-November the Russian ruble has depreciated to the U.S. dollar by 44%, the Euro – by 11%, the Polish zloty – by 12%. Today, the U.S. currency has strengthened even more.

The psychological factor also affects the currency exchange rate. Any instability immediately affects the behavior of citizens. Since the beginning of the year the outflow of deposits from financial institutions has reached over 30%, which had a negative impact on the banking system and on the exchange rate. Undermining of the credibility of the national currency and the desire to exchange savings for foreign currency put pressure on the exchange rate. In this regard, the NBU has introduced a number of restrictions on the foreign exchange market – for example, on withdrawal of deposits. Now, people are allowed to withdraw the maximum amount of UAH 15,000, though only after the deposit term expires. Early withdrawal of currency deposits is allowed only in local currency. Such rules have been criticized by those banks that can afford to pay their customers on time. After all, these restrictions hinder the influx of new deposits in foreign currency. Be that as it may, the NBU has no intention of cancelling these restrictions.

“There is a connection between the ability to buy the currency and the outflow of hryvnia deposits: as soon as citizens are able to buy currency freely, the outflow of hryvnia deposits immediately skyrockets. When such opportunities are limited, nobody withdraws national currency to keep it in a safety deposit box,” explains Ponomarenko. Hryvnia are left on accounts in order to earn interest. After all, today the interest rates on term deposits are on average 20–25% per annum.

Multi-taskers

There are several other important reasons for the devaluation, which the regulator prefers not to discuss. One of them is the sharp increase in the emission of the hryvnia. The NBU argues that while calculating emission it must consider the rate of the monetary base. In November, it even declined by UAH 4 bn, while in January–November it increased by only 7%, or UAH 21 bn. But this indicator does not give the complete picture of the amounts of money the NBU injected into the economy. In order to estimate it, it is necessary to calculate the index of so-called clean emission. In January–October alone it amounted to approximately UAH 80 bn (see Oleksiy Blinov on emission). This is much more than the central bank has put into circulation in the previous years. For example, in 2012 the emission was negative. The reason is the sale of reserve money, which tied the hryvnia and reduced the pressure on the exchange rate.

The main reason for the devaluation is the transition to the floating rate, which the IMF has been insisting for many years. The fund’s arguments are as follows: it is not the rate, but the price of other currencies relative to the hryvnia that is most important. The task for the NBU is not to support the rate, but to achieve price stability. One cannot argue with the arguments of the IMF when it comes to the economies of the EU or the U.S. Indeed, for citizens in those countries the dollar/euro rate is not important. Those countries are free to produce many goods and services and do not depend on imports. In addition, central banks of different countries hold their currencies or government bonds in their reserves next to gold. This is also an important stability factor for the currencies of these countries.

But in Ukraine, which exports raw materials and imports almost all consumer goods, devaluation immediately results in higher prices. For the period January–November the SSS forecasts an inflation rate of 21.2% and by the end of the year, according to forecasts of NBU Governor Valeria Hontareva, inflation will reach 25%. But it is obvious that the prices of many imported necessity goods have doubled and for some, such as medicines, they are higher. Prices of Ukrainian products have even grown due to the rising cost of fuel.

Therefore, transition to the floating rate in a weak economy, which is also rapidly decreasing, automatically leads to the collapse of the national currency. And amidst war and panic of the population it is meaningless to expect strengthening of the hryvnia.

Nevertheless, the NBU cannot change the rules of the game – they are dictated by the IMF as the main creditor of Ukraine. And today the need for the IMF’s funds is critical. “Next year, not even taking into account the money needed to import gas, the foreign public debt payments, including interests, will be close to US $10 bn. And as of the beginning of the year the reserves will be approximately US $8 bn,” said Blinov.

The main payment in 2015 – Russian Eurobonds – was US $3 bn. There are two series of Eurobonds maturing in the second half of the year: €600 mn and US $500 mn. Those are the largest payments. “Fortunately, they shall be transferred in the second half of the year. As to Russian Eurobonds, there is a risk that Russia may demand early repayment, seeing as the national debt at the end of 2014 will most probably exceed 60% of GDP. But in order to calculate this figure, it is necessary to wait for the GDP index for the full year, which the SSS will publish in March. Theoretically, they may claim it six months prior to maturity,” admits Blinov. In practice, this means that the IMF financial support of Ukraine is not the only critical factor, but also a monthly schedule of cooperation so that Ukraine finds the money to repay major loans on time.

At the same time, even if the NBU wants to strengthen the hryvnia through intervention, it would not be able to do so. “There are certain foreign exchange reserves. They are liquid, but their amount is too low to spend them to maintain exchange rates,” said Ponomarenko. The only thing the NBU can do is strengthen administrative pressure.

“Given the current state of international reserves, the situation on the foreign exchange market has entered a phase of uncontrolled use of economic levers and the NBU does not have any other mechanisms to deter national currency than administrative ones,” states the report from Atlant Finance. For example, if the hryvnia falls even lower – beyond the limit of UAH 16/USD, the NBU may allow the sale of currency only for the needs of critical imports. This is advantageous for pharmacists, who want to have the privilege of buying foreign currency without standing in lines, though it is disadvantageous for other importers. “It is a tough measure that will have a negative impact on the economy as a whole. Although, if the situation develops based on a negative scenario, I would not rule out such a possibility,” Ponomarenko concludes.

“The reality is that today the objective rate should be in the range of UAH 17–18/USD, given the current level of foreign exchange reserves and the monetary base. And we must achieve it in the near future,” says the statement from Atlant Finance. Ponomareko refrained from predictions for the hryvnia / dollar rate, saying only that it will still be volatile. Which means in the near future we may see both a sharp strengthening of the national currency (which is unlikely), and its sharp devaluation. The expert admitted that today in Ukraine there are no derivatives with the help of which it would be possible to hedge against exchange rate shocks. But such tools will soon appear at three platforms – the Ukrainian Exchange, Perspektyva and the Ukrainian Interbank Currency Exchange. They submitted the documents to the NBU for approval of standard forms of futures contracts on derivatives trading. So, in a few months importers may afford to insure against currency fluctuations.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.