Finance

financial resultThe losses of problem banks cost billions for the banking system

In January – May 2014 the banking system of Ukraine suffered losses in the amount of UAH 10.4 bn, reported the NBU. Indicators of the financial institutions recognized as insolvent contributed most to the negative financial result. Since the start of the year, the number of problem banks reached 11, while the total volume of losses over the first five months amounted to UAH 14 bn. Aside from this amount, the revenues of the banking system reached UAH 3.7 bn since the start of the year.

On negative side

The losses were due to interest expenditures exceeding interest revenues, additional deductions to reserves as the credit portfolio quality deteriorated and the increase in administrative expenses, says Vadym Berezovyk, member of the Global Association of Risk Professionals. The banks charged interest and allocated more money to the reserves on loans, while borrowers did not hurry to repay their debts. Moreover, financial institutions still had to pay interest on deposits and balances on current accounts.

As Capital wrote earlier, experts forecast a further increase in the number of problem banks and banks that are in the process of liquidation. Only 9 of 37 commercial banks passed the stress test and do not require additional capitalization. The owners of the remaining banks will have to come up with the funds to increase their capital. If shareholders fail to support their banks, the NBU will acknowledge their insolvency and the Deposit Guarantee Fund of Ukraine will introduce their provisional administration. “The banking system has serious problems due to the large number of unsustainable banks. This undermines the trust towards the entire banking system,” says Stanislav Dubko, chief executive at the Ukrainian Credit Rating Agency. Experts estimate that the banking system requires a total capital volume of UAH 50 bn. Among pressing problems of the banking system are the withdrawal of deposits and, as a result, huge liquidity gaps. Financial institutions are currently paying more than they get. The level of trust in the banking system is in decline and it is difficult for average citizens and companies to save money in conditions of the economic recession.

Reserve plan

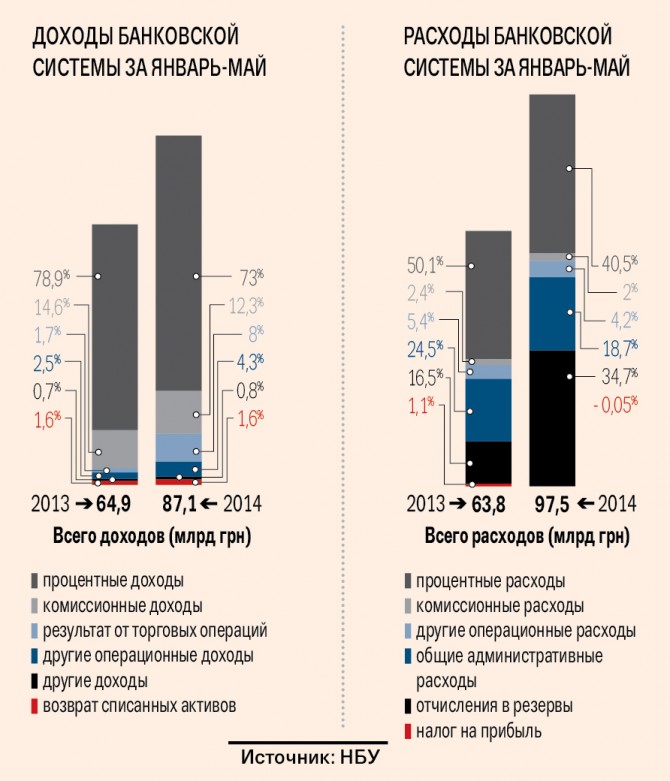

Compared with the same period of the previous year, revenues and expenditures of Ukrainian financial institutions increased. The latter, however, grew more dynamically: expenditures increased 52.8%, while revenues – by only 34.3%. Expenditures grew primarily due to the formation of reserves. In the structure of expenditures, the share of the reserve contributions has been stable at more than 30% since February 2014. The volume of contributions in May amounted to UAH 10 bn reaching UAH 33.8 bn over the five months of 2014. Financial institutions spent three times less on reserves in the same period last year. Solvent banks made additional contributions to the reserves on currency loans due to escalation of the dollar rate against the hryvnia, says Dmytro Hrydzhuk, CEO of Khreshchatyk Bank.

Compared to last year, the banks increased their administrative expenses by UAH 2.6 bn. Experts believe that this could be due to an increase in the amounts allocated for security and optimization of personnel. “In certain periods we increase our security expenses due to the increased crime rate in the country,” says Hrydzhuk.

The banks were also forced to spend more on legal and consulting services, trials and fees of debt collectors, says Berezovyk. “In the period of instability, a number of borrowers went from the category of solvent clients to certain problem categories. Sometimes banks use intermediaries to find a compromise and restructure their debts. If that does not work, they have to hire legal companies to take the case to court,” explains the expert.

Tax declaration

Trade returns of the banks saw the highest increase in the January-May period, as the banks’ profits from forex transactions increased nearly sevenfold compared to the same period of the previous year to UAH 7 bn. “The volatility of prices on foreign exchange market helped banks earn more than they would had the rate been stable,” says Dubko.

The banks earned UAH 10.7 bn on fees in January-May, which is UAH 1.2 bn more than in January-May 2013. Over the past several years, the gradual increase in the share and volumes of fee revenues became a noticeable trend, emphasized Dubko. The absence of favorable conditions for lending forces the banks to focus on payment processing services. In addition to that, the part of revenues received by banks in consumer lending is also attributed to the category of fees. Despite that the market contracted – due to annexation of Crimea and the lower volume of transactions in the eastern regions – the volume of fee revenues continues to rise, says Hrydzhuk. The banks will continue to expand their range of services for individuals and legal entities focusing on fee revenues.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.