Economy

contractsWhile Ukraine plans to sign the economic part of the EU Association Agreement on June 27, neither the government nor businesses are prepared for this

On June 27 the European Union will sign the economic part of the Association Agreement with Ukraine. After this the process of forming the Free Trade Zone (FTZ) between Ukraine and the EU in a bilateral format and a number of other economic innovations will be introduced. Ukraine will have 10 years to adapt to the European rules of the game, a path that the government bodies and business will be forced to go along.

The first step

Preparation for the practical implementation of the Association Agreement (AA) in general and the Free Trade Zone in particular should be accomplished by government agencies. Experts at the International Center for Policy Studies (ICPS) believe that the mechanism of implementation of the agreement should include two elements: a national system for coordination of implementation of the AA by those responsible for this task and a national program for implementation of the AA. Currently, Ukraine has neither of the two.

The departments responsible for the European integration in various bodies, mainly the Ministry of Economic Development and Trade, the Ministry of Foreign Affairs, the Ministry of Justice and the National Agency for Civil Service Affairs, are in charge of interagency coordination of implementation of the AA. Such “atomism” of duties, responsibilities and resources undermines the effectiveness of preparation for signing of the AA. “In conditions when the list of tasks and responsibilities is not clearly defined, the authorities are unable to adapt their internal structure for their efficient implementation and achievement of the results,” says Director of the European Integration Department at ICPS Volodymyr Prytula. Instead, the expert says the government should create a single coordinating body for the European integration, which would be responsible solely for implementation of the program.

The best solution is that the Ministry of European Integration be headed by Ukraine’s First Deputy Premier – Minister of European Integration, says Vadym Tryukhan, a member of the Ukrainian delegation at the AA negotiations with the EU in 2007 – 2010 and chief expert of the working group for the European integration, who headed the Coordination Bureau for European and Euro-Atlantic Integration in 2008 – 2010.

Eliminating the National Euro 2012 Agency, which is no longer needed and the State Agency for Investments and National Projects, which proved to be inefficient, would make this possible. “Only one institution, namely, the ministry should deal with the reforms and the European integration. Without it fulfillment of the conditions of the AA will fail,” believes Tryukhan. A national agency for similar affairs or a profile government office within the structure of the Cabinet of Ministers would be a more low-cost option for forming a joint agency. At the same time, it would be more rational to redistribute powers to concentrate an essential part of the duties for the European integration within the framework of such a body, says Prytula.

Tryukhan says that if such ministry led by a respective deputy prime minister is formed, the latter should be granted sufficient powers to implement the policy of joining the EU, systemic reforms and attracting investments and technical assistance for such purposes.

According to the “100 days – 100 steps” program initiated by the government, the Cabinet was supposed to develop a national program for coordination of implementation of the AA, defining the type of coordinating body in April. However, the deadline was not met. At the end of May, Premier Arseniy Yatsenyuk finally announced the creation of a government office for the European integration, as well as new positions of the Deputy Minister for European integration in each ministry. However, Prytula says the government office has very limited functionality for coordinating the preparation of government agencies to the European integration.

Secondly, almost a month after Yatsenuk’s proposal, the Euro-integration government office exists only on paper. Tryukhan says the Cabinet is currently developing a provision on its operation and is drafting a personnel tender. It is expected that the government office will open in a month or two.

In addition to routine tasks, it will also prepare the basis for the creation of the Ministry of European Integration. However, with regard to this department, as well as the office of a specialized deputy prime minister that would head the agency, there is no consensus in the current government. During the election campaign President Poroshenko mentioned an agreement with the EU on creation of the office of a Deputy Prime Minister or a First Deputy Prime Minister for European Integration. The VR Committee for European Integration also supports the need for establishing such a position. However, the Cabinet has yet to announce such a step.

The national program for implementation of the AA, which the government promised to adopt back in April, is still not ready. At the moment, there is only a draft of this document. However, according to Head of the Foreign Policy Department at ICPS Olena Zakharova, the document is a list of the EU’s acquis communautaire with specified deadlines (which often simply duplicates provisions of addendums to the text of the AA) and responsible persons. Instead, the expert believes there should be a program of implementation of the AA in the form of public policies in specific areas which should be discussed beforehand with all interested parties. It should include the state of the current situation, the essence of innovations and the expected result. Such a program should be amended from time to time – at least once a year – to show the progress achieved, the size of financing allocated by the EU and the Ukrainian budget, as well as comments from various European institutions. State agencies responsible for implementation of such policies should report regularly to the coordinating body, which in turn would be responsible for the national report.

Making up for leeway

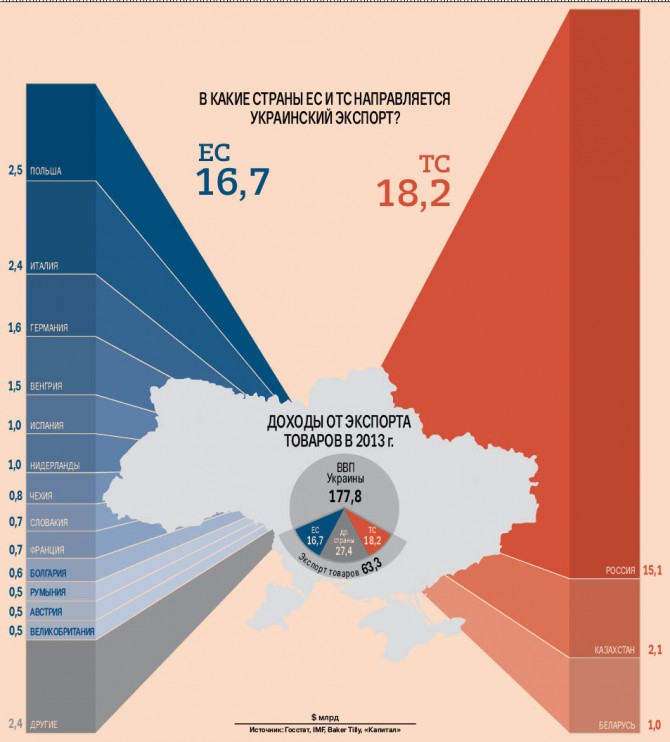

Adaptation of Ukrainian business to the AA and, in particular, to the FTZ will be versatile. For a number of industries there is nothing new in the European rules and standards. For example, based upon data in 2013 the share of the EU in exports of agricultural products was 23%. These are mainly products of crop farming. In particular, the EU accounts for 43% of Ukraine’s corn exports, 36% of rye, 41% of buckwheat and millet, 69% of grain sorghum and 95% of seeds and fruits of oil plants.

Also, there is no need to adapt to the European market for producers of ferrous metals, one fourth of which are exported to the EU. The situation is similar in the mineral products sector (35% of exports goes to the EU), as well as the textile industry (67%). However, many sectors of the Ukrainian economy are still not ready to supply products to Europe. Up until now, they have been selling it mainly to member countries of the Customs Union, whose standards differ from those in Europe.

Among them are the automotive industry, which exported 74% of its products to the CU and only 6% to the EU, engineering (54% vs. 21%) and the chemical sector (36% vs. 15%). At the same time, Europeans are not really interested in the products of these industries. For example, goods that are one of the main items of Ukrainian exports to the CU – locomotives, railcars and other means of transportation for railway – are purchased in Europe only by the post-Soviet Baltic republics – Estonia and Latvia. Railcar builders and other companies previously not focused on EU industries, which still dare to move to the West, will have to reequip and modernize their production facilities and certify their products according to European standards.

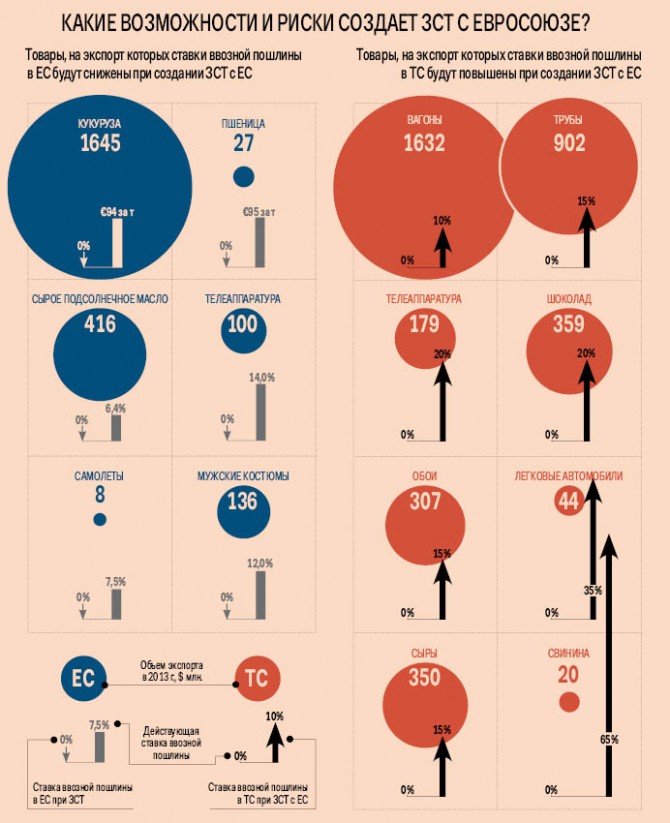

By mastering the European market, Ukrainian producers will earn considerable profits. While up until now the Ukrainian market was more open for European goods, rather than the EU market for Ukrainian products, from this point on the EU will become more accessible for Ukrainian producers. Tariffs on 98.1% of the goods will be reduced in the FTZ. Europe will reduce the average rate for all groups of Ukrainian goods from 7.6% to 0.5%. At the same time, Ukraine plans to reduce duties from 4.95% to 2.42% on average. Later, within the next 10 years, the EU plans gradual reduction of the average duty rate to 0.05%, and Ukraine – to 0.32%.

The effect of the FTZ for Ukraine’s economy can be assessed based on May results. On April 23, 2014 the EU lowered rates of the duty for Ukraine within the framework of 6-month unilateral trade liberalization. Some agrarians, in fact, already managed to take advantage of this opportunity. According to Assistant General Director of the Ukrainian Agrarian Confederation Oleksandr Yaroslavskiy, from April 23 to June 4 Ukrainian enterprises exported to the EU 11 t of tested sugar products, 40 t of starch, 110 t of processed tomatoes and 367.7 t of barley that is exempt from duties. But the major breakthrough was made by honey producers. During the first month of trade preferences they have used more than one third of the quota, exporting to the EU 1,564 of 5,000 t of duty-free honey.

By the way, the agricultural sector will benefit from the FTZ more than others. The EU promises to reduce tariffs on agricultural products from 19.8% to 0.6% on average, while Ukraine promises to cut duties from 9.24% to 6.77%. However, Brussels will retain the right to use tariff quotas. “Only those companies that will manage to be the first to import goods to the EU and fall within the limits of such quotas will benefit from the reduced rates. Others will be able to supply the goods on condition of payment of duties at previous rates,” says adviser at the Department of Tax and Legal Services of PwC Ukraine Oksana Drozach. Accordingly, the lower the quota for certain products, the more companies producing them should hurry up with customization of their internal processes to the EU quality standards.

At the same time, the majority of quotas are completely detached from the export realities of recent years. Yaroslavskiy says the volume of quotas for agricultural products was calculated on the basis of statistical data for 2005, when rates of Ukrainian agricultural exports to the EU were much lower than today. For example, among the other quotas still based on the old data are those for export of poultry (16,000 with an increase to 20,000 t within five years), wheat (950,000 t with an increase to 1 mn t) and corn (400,000 with an increase to 650,000 t). For some types of products such restrictions are not critical, for example, wheat as Ukraine sold only 101 t of it in 2013. But for other products such quotas actually neutralize the effect of trade liberalization. For instance, last year the export volumes of corn to the EU reached 7.2 bn t, which means its current quota will cover only 5% of exported commodities.

Side effect

Cooperation with the EU within the framework of the AA is not limited to foreign trade – Ukraine’s economy can also expect a number of changes in other sectors, first and foremost, in the terms of taxes. “Ukraine will have to harmonize its rules of taxation with the excise tax and the VAT and regulation of services with the EU rules,” says Drozach.

Replacement of direct taxation with indirect taxation is the main objective for innovations. To do this, for example, the excise tax will have an expanded tax base and its rates will increase. So, electricity and natural gas will be classified as excisable goods. At the same time, the rates of excise duties on diesel fuel may increase by 4 times and on other types of fuel – by 2.6 times. The lawyer says this will urge Ukrainian companies to start using energy-efficient equipment and alternative fuels – solar or wind power, etc.

Also, due to the increased excise duties alcohol and cigarettes will become much more expensive. The excise rate for most alcoholic beverages may rise by 1.5 times, for cigarettes – by 6 times, and for tobacco for roll-up cigarettes – by 3.5 times. Experts warn, however, that there is no need to hurry with a radical reform in the tax field. Ukraine will have ten years to introduce the changes, thus avoiding abrupt and negative short-term effects.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.