Business

trendsAttempts to regain the strength of steel

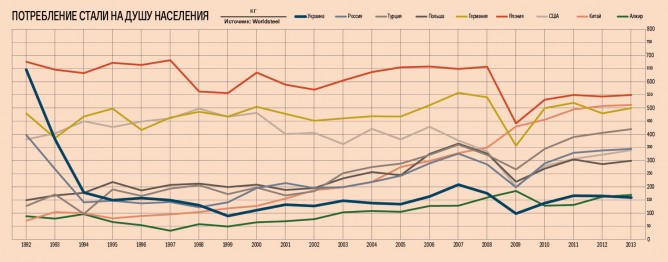

The paradox of the Ukrainian economy is that having sufficiently developed metal-consuming industries (mechanical engineering, metallurgy and the mining sector), a well developed infrastructure and considerable amounts of residential and commercial buildings, steel consumption per capita in the country has not exceeded 170 kg for several years in a row. Moreover, the metal fund of the country is steadily declining every year. What does this mean? This means Ukraine is classified neither among the developed nor developing countries.

Usually, a low growth of metal fund is attributed to two types of countries: economically developed countries, the GDP per capita of which is more than US $15,000, and underdeveloped countries, where it does not exceed US $1,000. In the first case, economic growth or stabilization does not necessarily lead to an increase in consumption of steel that remains persistently high. Generally speaking, in these countries everything that was needed has already been built and is operating. Steel is consumed not for expansion of the infrastructure, but for its maintenance. In poor countries, however, there is virtually no industry. The infrastructure is limited to dirt roads, hence, there is no need for steel as construction material and steel consumption remains consistently low there.

Only with its level of GDP (US $4,000 per capita in 2013) Ukraine ends up in exactly the same field of dependence. Such countries are legitimately called developing. Their steel consumption per capita should grow rapidly, which would be an indicator of their economic growth. Nevertheless, in Ukraine the figure is, first of all, extremely low, and secondly is steadily declining: in 1992 every Ukrainian consumed 646 kg of steel, last year this figure was 166 kg, notwithstanding the fact that Ukraine’s infrastructure and economy need a growth in steel consumption more than ever.

Interestingly enough, with the collapse of the Soviet Union the same trend was observed in neighboring Russia. But in Ukraine, the amount of domestic steel consumption, while having dramatically declined over three years – from 33.6 mn t in 1992 to 7.8 mn t in 1995, has since remained approximately at the same level today, according to Worldstell Association. During this period Russia almost managed to return to the level of steel consumption registered in 1992 of 48–50 mn t per year.

Requirements

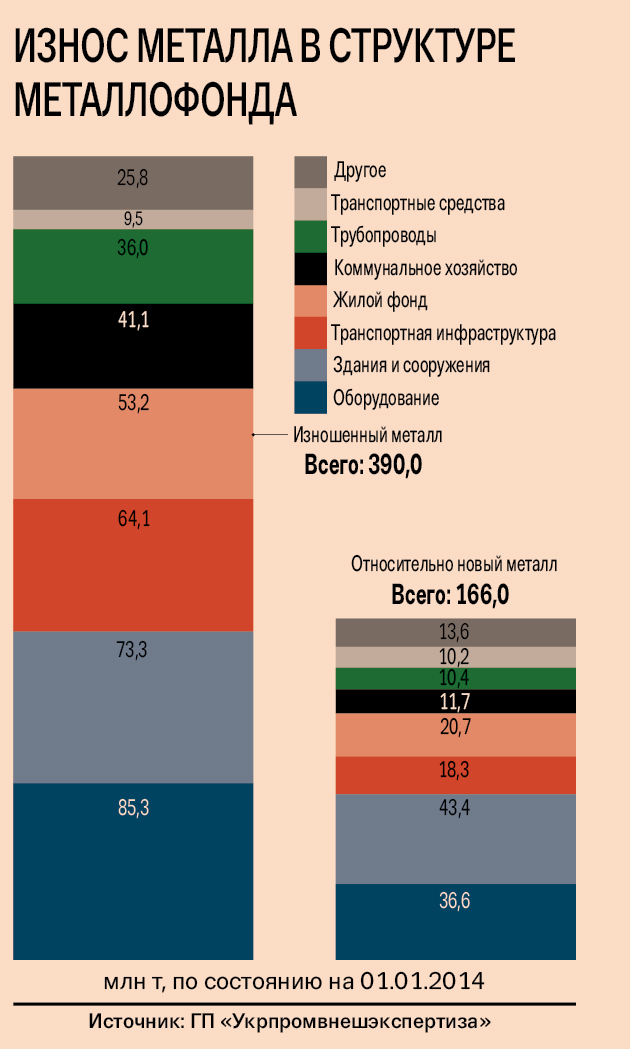

In 2013, the country’s metal fund (i.e. all functioning equipment, vehicles, infrastructure facilities, houses and constructions made entirely or partially of metal) was estimated at 556 mn t. Of this amount, 536 mn t accounted for fixed assets (buildings and facilities, housing, equipment, pipelines, the transport infrastructure and utilities) and 20 mn t were means of transportation – cars, trains and locomotives, ships, agricultural machinery. At the same time, according to Director of the State Enterprise Ukrpromzovnishekspertyza Volodymyr Vlasyuk, 30 years ago Ukraine’s metal fund was three times larger and in 1982 was estimated at 780 mn t.

Since then the country's metal fund has been steadily declining, although at different rates. For example, in the period 1982–1995 the average pace of reduction was approximately 4 mn tonnes per year. The notable rise in negative trends was observed in 1996 – 2006, when the pace of decline in the metal fund tripled to 12 mn t per year. It was during these years that the exports of scrap metal increased dramatically due to the mass cutting of metal at steel mills that were shut down, abandoned pipelines and other facilities and the domestic consumption of rolled steel decreased to 2.3 mn t per year. Naturally, this could not compensate for the losses. In the period 2007–2013, the rate of decline slowed down to approximately 5.5 mn t per year. But not once during that time did the metal fund see any growth (even in the years when consumption grew, the losses still were higher).

“As a result we have two problems: the ongoing decline of the accumulated metal fund and the increase of wear and tear of its structure, which is an indication of deindustrialization of the country,” says Vlasyuk, stating that the average wear and tear factor in Ukraine is nearly 70%.

This points to the degradation of the country, because not only industrial or infrastructure facilities and assets are worn, but also the homes of Ukrainians. The housing stock has one of the highest levels of wear of metal constructions (72%), and, hence, the buildings in general. In municipal infrastructure, pipeline transport, road and railway transport infrastructures this figure is nearly 78%. In this case, Ukraine’s transport fleet seems to be the most trouble-free – it has been worn by only 48%. However, such a rate is mainly due to the sharp rise in the consumption of passenger cars in the pre-crisis period. Considering the wear and tear of automobiles in the country, their share is 30–33%, while the wear and tear of railway transport (cars and locomotives) was registered at 75%.

Industrial equipment in Ukraine is worn out by 70%, which, in fact, is the reason for the technical and technological backwardness of many businesses and even entire industries. The total volume of worn out metal is close to 390 mn t and all this obsolete hardware requires updating, otherwise the country’s industry will simply collapse in the nearest future.

Projects

The quite high level of wear and tear of the metal fund is not the only problem for housing and municipal systems. First of all, it is too high. Secondly, experts say that projects aimed at its renewal are deprived of the commercial component, although they are indispensable in terms of the quality of life. Among them are reconstruction of the municipal infrastructure (boilers, water supply, sewage, heating systems and electricity networks, pumping stations and sewage treatment plants). All this requires at least 41 mn t of metal. Social housing would increase the potential demand for metal in the amount of 12 mn t. At the end of 2013, more than 6 mn people required improvement of housing conditions, but no more than 15 – 20% of them could provide the effective demand for new apartments.

Even such strategically important projects as upgrading of the transport infrastructure and fleets do not require such a large quantity of metal. For example, according to analysts, the demand for railcars and locomotives will amount to 230,000 units by 2023. Implementation of the project for their production would increase domestic consumption of metal for this period only by 5 mn t. Modernization of port infrastructures costs nothing compared to the renewal and modernization of utilities. In particular, expansion of the capacity of railways in port stations will increase the demand for metal by only 0.065 mn t, renewal of port cranes (which are 96% worn out) will make it possible to increase domestic consumption of rolled steel by only 0.25 mn t.

Even renewal of railway tracks, the total weight of which is 6.6 mn t (67% of those that need urgent replacement) may spur a rise in demand for rolled metal by only 4.4 mn t.

Analysts are hoping on renewal of once lost positions in water transport, in particular inland river transport. The development of domestic shipbuilding could help increase the demand for metal products by 6 mn t. Today, approximately 98% (170 mn t) of Ukrainian cargo is transported by foreign fleets. Experts also do not rule out the prospects of development of agricultural equipment (tractors and harvesters are worn out by 70–80%), which will increase the demand for domestic rolled metal by 1 mn t.

But it is one thing is to estimate the amount of iron needed to be replaced in the country and the other is to find the money for it. For example, modernization of the port infrastructure of Ukraine requires at least UAH 7.5 bn. For intensive renewal of rolling stock we need UAH 100 bn. But supposing these projects still have commercial impact and can be stimulated by a special government regulation (for example, legislation aimed at reduction of the allowable life-span of railway cars), modernization of the metal fund in the housing and utility sector requires huge investments (approximately UAH 1.6 trillion), which nobody will be able to provide in the coming years.

Participation

The problem is that even having found all these means it is impossible to redirect Ukrainian metallurgy to ensure domestic needs in the foreseeable future. In the period 1992–2013, the output of steel in Ukraine has fallen by 8.9 mn t – down to 32.8 mn t. But most importantly, Ukrainian metallurgy is completely oriented on exports (80% of the metal is exported from the country) and the export gauge of semi-finished products is 80%.

“If we consume imported steel for modernization of the metal fund, it would deal a severe blow both on metallurgists and the economy as a whole, because the cost-effectiveness of implementation of modernization projects will be pitiful,” warns Vlasyuk.

Even though many of the aforementioned projects can be implemented using the range of steel manufactured in Ukraine, it is also necessary to have rolled steel that we do not produce or produce in limited amounts, particularly for the modernization of industrial equipment, vehicles… Ukrainian steelmakers are inferior to foreign competitors in high-tech product mix positions, in particular, in rolled alloy steel: flat-rolled coated products, cold-rolled coils, galvanized rolled steel and machine-building wires. The import volumes of these headings are steadily growing. In general, the share of imports in Ukrainian domestic demand increased from 17% to 22% since 2007 to 2013.

Last year an interesting trend was observed – the supply of items excessively produced by Ukrainian factories has significantly increased. “In 2013, approximately 40–50% of steel imported to Ukraine could be replaced by domestically produced goods,” says Head of the Department of Analysis of Ferrous Metallurgy Markets at Derzhzovnіshіnform Oleksandr Sheiko. For example, our customers (railcar manufacturing companies) switched to the supply of Russian sheets, as they were 10–15% cheaper than Ukrainian products.

It is possible that during a hypothetical period of growth in domestic consumption of steel, which will be triggered by the implementation of projects for upgrade of the metal fund, imported steel products will also be cheaper and better than their Ukrainian counterparts.

Analysts say Ukrainian steel industry is technologically and technically lagging behind its main competitors – Russia, Turkey, the EU and China. High energy consumption of Ukrainian steel is still produced in open-hearth furnaces (20% of total production) and poured into molds, while the other countries have almost fully abandoned these technologies. Only 50% of Ukrainian steel was produced by continuous casting machines (CCM), whereas all over the world companies produce 97% of steel using such machinery.

Vice President of the Association of Companies of the Ferrous Metal Industry Volodymyr Hranovskiy says in today's world for the production of flat products companies use more sophisticated technologies – thin-slab continuous casting machines that consume approximately 800 MJ per ton, while continuous casting machines (CCM) and transit rolling of sheets consume 1,500 MJ per ton, ingot casting and rolling of sheets – 2,600 MJ per ton. Naturally, such significant power consumption is an unbearable burden for the cost of the final product.

“In order to maintain efficiency in the production of metal products, approximately US $150 per ton of produced steel must be invested based on international practice. Russia spends approximately US $100 per ton of steel for this purpose,” said Hranovskiy, adding that based on the results of last year Ukraine has invested only US $20 in each ton of steel.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.