Technology

forecastsThe telecom market in Ukraine could deflate by US $500 mn within 3 years

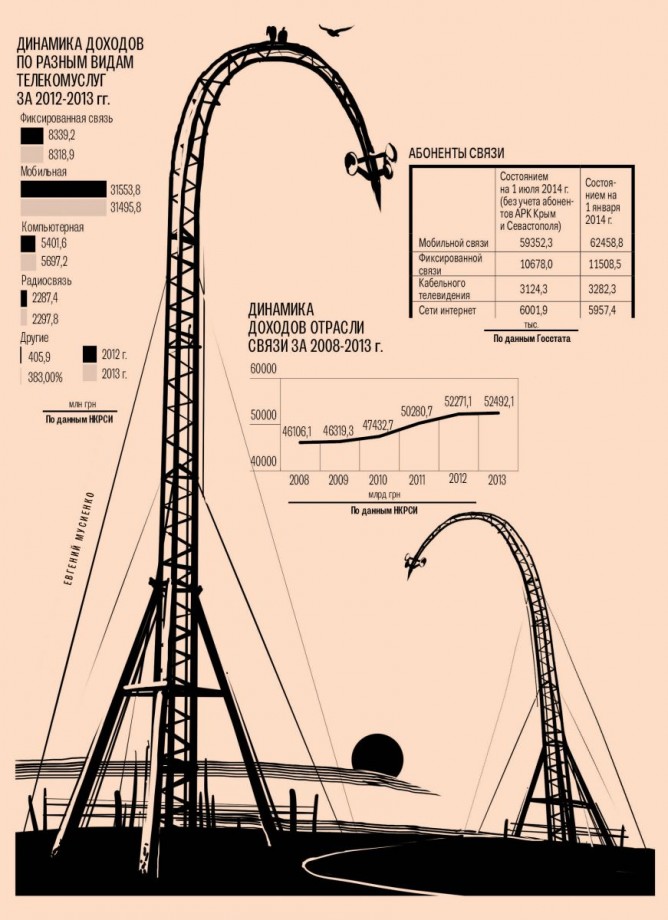

In early October the analytical company Pyramid Research published a forecast of the Ukrainian telecommunications market development until 2018. Based on its estimates the industry’s growth slowed down back in 2013, when the market was worth US $5.2 bn (by 3.3% more than in 2012). Starting from 2014 this segment of the economy will be declining at an average annual rate of 2.4% and will drop by US $500 mn to US $4.7 bn by 2018. The expected decrease of the turnover on the market, according to Pyramid Research, is due to the current political unrest and economic difficulties in the country. “The annexation of Crimea and the military conflict in the east, as well as disruptions in operation of networks and devaluation of the national currency, all have a negative impact on people’s purchasing power,” market analysts agree.

Politics: the greatest barrier to economic growth

Mobile communications remain the largest telecom sector, generating 45.4% of its revenues, according to Pyramid Research. Noteworthy is that the State Statistics Committee (SSC) has already reflected in its report for 6 months of this year how the annexation of Crimea affected this sector: the number of Ukrainian mobile subscribers fell by 3 mn (from 62.3 mn to 59.3 mn SIM cards) and all three national GSM operators (MTS Ukraine, Astelit (life :)), Kyivstar) are experiencing serious problems in Crimea or have been forced to shut down their operations on the peninsula.

The cable TV and Internet access segments did not lose as many clients due to the annexation of Crimea – 135,000 and 120,000 subscribers, respectively, according to the SSC. The basic losses in revenues of Ukrainian legal entities on paper were incurred by Volia, which leased its network and brand name in Crimea to a Russian company, and Ukrtelecom, which lost control of the network in Sevastopol. In the rest of the peninsula its owner SCM is tries to collect subscription fees through the new Russian legal entity Our Telecom, which is registered in Cyprus. Ukrtelecom suffered the greatest loss in the occupied territory – nearly 4% of its revenues were generated by subscribers on the peninsula – and MTS Ukraine, which had almost 10% of all its business and revenues in Crimea.

It is difficult to predict the operators’ losses in the east of Ukraine. The region still suffers from hostilities and it is impossible to say which assets will be controlled by the major players.

Mobile revenues are dwindling

The telecom market is also sagging because most frequent users of its services – namely, mobile subscribers – began saving money and spending less. For example, at the end of the second quarter of 2014 the average revenue per user per month (ARPU) for MTS Ukraine decreased in comparison with the same period in 2013 by 5% (down to UAH 36), for Kyivstar – by 2% (down to UAH 35.7). In the future, the trend may continue due to the fact that more users prefer smart phones and are starting to save on calls by using available Wi-Fi networks, as well as cheap GPRS-Internet. In view of strong competition, mobile operators are in no rush to openly raise their tariffs for basic services.

“We insist on the need to tender for new technologies, fair redistribution of frequencies and equal access to new technologies for all operators,” said acting CEO of life :) Erdal Yayla. Otherwise, the uncertainty with the introduction of 3G, the absence of any steps for introduction of the MNP (mobile number portability – a service which makes it possible to retain mobile telephone numbers when changing from one mobile network operator to another), simplification of licensing procedures and other regulatory actions will turn the current stagnation of the market into recession, he warns. “In 1–1.5 years after the issuance of 3G-licenses we can count on positive dynamics in this sector,” says Marketing Director at MTS Ukraine Oleh Reshetin.

Director for Development of the Mass Segment at Ukrtelecom Denys Zakharenko suggests that in 2014 the mobile market will show a slight decline. “The hryvnia figures will be somewhat supported by foreign exchange earnings from the dollar and international calls to Ukraine. Usually, this is around 10% of total revenues,” he said. “Taking into consideration the shutting down of operations in Crimea and the difficulties in the eastern regions of Ukraine, we believe the single digit-drop (by a few percentage points – Capital) in the telecom industry this year compared to 2013 and in 2015 compared to 2014 an optimistic trend,” agrees Reshetin.

Additional payment for content and Internet

Telecom operators in other segments are in a better situation, as many of them are no longer ashamed to admit their economic problems and raise their tariffs. For example, Volia announced an increase in the cost of its services by an average of 7% as of September. Ukrtelecom raised tariffs for local communication by an average of 15.5%.

Volia’s CEO Gyorgy Zsembery said in a conversation with Capital that the rates for Internet and cable TV will definitely be increased, but not everywhere. “Prices are unlikely to rise in small towns, which usually have monopoly operators and people pay UAH 200 per month. But in larger cities the prices will definitely be raised. After all, operators pay for content and equipment in dollars,” he said.

Zakharenko predicts that this year the landline segment will increase even only by a few percentage points due to the increase of boundary tariffs for the service planned by the government. The expert believes that such a situation will persist for several years. “The artificial hike in prices still covers the loss of income due to customer attrition (disconnection of home phones),” explained the manager.

Internet is still young

As to the Internet market, Zakharenko believes that a steady growth of earnings will be achieved in this segment within the next few years due to the increased penetration of the service. “In future it will be possible to connect another 10% of households in major cities and the potential in county centers is 20–30%, while in rural areas and villages more than 50% of households are not connected to the Internet,” he said.

But, on the other hand, the market is “drained” by dumping. In apartment buildings Internet operators suffer from the excess of infrastructure. Zakharenko says 50–60% of ports are simply idle and marketing experts come up with different ways to use them to earn at least some money. Such a situation will not change until the market is consolidated in the coming years. “Roughly speaking, some 150 of the current 1,500 providers should remain on the market,” says the manager of Ukrtelecom.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.