Finance

InvestmentsRisk of default inflated prices of the bonds of Ukrainian banks

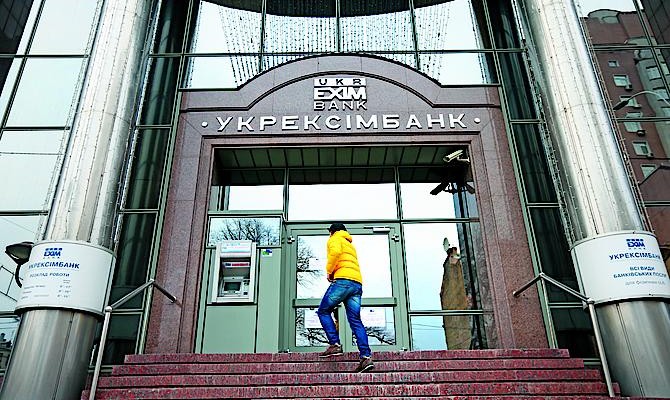

Ukrainians could have earned a pretty penny on European debt securities issued by Ukrainian financial institutions had the parliament allowed them to freely invest abroad. For instance, yesterday the yield of Eurobonds issued by PrivatBank that will mature in 2015 reached 36.4% and those issued by state-owned Ukreximbank – 39.5%. These debt instruments are traded outside the stock exchanges, while the minimum settlement amount (the price of one lot – Capital) reaches US $100,000, according to Specialist of Debt Instruments Sales Department at Dragon Capital Serhiy Fursa.

Making the bid

Experts believe that such a high yield of international bonds issued by Ukrainian banks can be explained by the simple fact that foreign investors are edgy, and foresee a high probability of Ukraine’s default and default of the aforementioned financial institutions in their forecasts. For instance, yesterday the yield of Ukraine’s Eurobonds maturing in 2015 was 22.5%. The market also includes expectations of future problems into the current price, while the situation with the “Ukrainian risk” is rather complicated. Indeed, there is a risk of restructuring of many Ukrainians Eurobonds that will mature before 2016.

“PrivatBank and Ukreximbank are strong financial institutions and I trust them,” assured Manager of the Foreign Market Sales Department at ART Capital Roman Lysyuk. “However, the market is not ruling out the possibility of non-repayment of coupons, transfer of the terms of repayment and partial reduction of the outstanding face value of Eurobonds by 20-30%.”

Also, the problems with repayment of Eurobond liabilities by the agricultural company Mriya and VAB Bank scared off investors. As a reminder, VAB Bank performed restructuring of its obligations for Eurobonds in the total amount of US $88.25 mn this past summer, having extended the maturity term for another five years until June 2019. Earlier, Finance & Credit and Nadra Bank restructured their bonds. These financial institutions simply have no hard currency available to repay debts to their investors.

PrivatBank and Ukreximbank may resort to debt restructuring since Ukrainian banks are short of liquidity due to the strong outflow of deposits, believes analyst of the banking sector at ICU Group Mykhailo Demkiv. “At the moment, plans for restructuring the bank’s Eurobonds are not under consideration,” the press service of PrivatBank informed.

Both banks require capital increase. As Capital wrote earlier, PrivatBank approved the decision on the capital increase of UAH 4 bn in 2014-2015. The capital increase that the state-owned Ukreximbank requires remains undisclosed.

Hunger is no joke

At the same time, Ukrainian investors understand that the problems of Ukreximbank and PrivatBank are most likely to be resolved and believe that their securities are “quite reliable”. “The Eurobonds of Ukreximbank are very attractive securities and with a high degree of probability that they will be repaid,” believes Senior Analyst at Expert-Rating Vitaliy Shapran. “The high yield is due to the fears of investors that it will be difficult to buy those volumes of hard currency required for repayment by Ukreximbank on the Ukrainian foreign exchange. However, I am convinced that the bank will be able to purchase these volumes.”

Today, it is difficult to find international bonds with a similar yield and acceptable risks. “Turbulence on the market does not allow for finding similar notes. Bonds maturing in 2015 issued by major agrarian holding companies have much lower yields (Myronivskiy Khliboprodukt – 18.7%, Agroholding Avangard – 25%), while SCM companies have a much higher yield (DTEK – 71.9%, Metinvest – 77.5%),” says Director of Cbonds.Info in Ukraine and other CIS countries Serhiy Lyashenko. Unfortunately, Ukrainians do not have direct access to the purchase of Eurobonds. For this simple reason, Ukrainians can turn a profit only by purchasing them through companies registered in offshore jurisdictions, such as Cyprus or Baltic countries.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.