Business

reformThe government will not rebuild most of the shut-down mines

In a short while Ukraine is expecting the arrival of the first vessel with South African coal. It carries 85,000 t of anthracite intended for burning at the Centerenergo thermal power plants (TPP).

As a reminder, on August 19 the Ukrinterenergo SE signed a contract with Steel Mont Trading Ltd. for supplies of 1 mn t of coal this year. That is how much Ukraine needs to fully load the three Centerenergo TPPs by the end of the year (in Vuhlehorsk, Zmiyiv and Trypillya).

Based on the estimates of the Ministry of Energy and Coal Industry by the end of the year Ukraine will have to import 4.2 mn t of coal, which would entail additional costs for the generating companies in the amount of UAH 1.5–2 bn. Contracts for the supply of imported coal were also signed by private companies, which by the end of the year will separately import 4 mn t of coal from Russia (those are the largest energy holding DTEK and DonbasEnergo).

However, it is likely that the demand for imported coal will grow as the mass transition of the population from gas to electricity (for example, as a result of replacement of boilers, which today is subsidized by the state through Oschadbank) will mean an increase in the consumption of electricity. “It is quite likely that this year we will import 10 mn t of coal”, predicts member of the Supervisory Board at the Institute of Energy Strategies Yuriy Korolchuk, noting that imports will kill the domestic coal sector. Other analysts also believe that buying black gold abroad will cast doubt on the economic viability of the domestic coal industry, particularly state-owned mines.

Situation

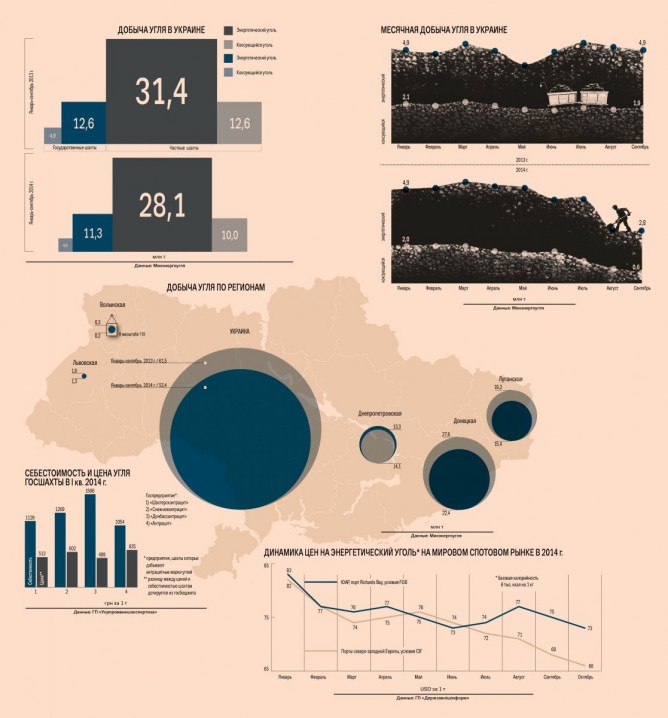

In January–September 2014, Ukrainian mines produced 53.4 mn tons of coal, which is 13.2% less than in the same months in 2013, according to the Ministry of Energy and Coal Industry. Production dropped at state-owned mines (-12.6%) and the private mines (-13.4%). Notably, reduction of extraction started in July and in August the pace of the decline significantly increased. “At the beginning of August 50 state-owned mines were operating, but due to the aggravation of the situation in the Donbas region in mid-August 26 of them were forced to shut down,” explained Director of the Department of the Functioning and Reform of the Coal Industry at the Ministry of Energy and Coal Industry Oleksandr Vivcharenko. Based on the optimistic forecasts of industry analysts coal production in the country will be 70–72 mn t in 2014 and according to pessimistic forecasts – 63–65 mn t, which is 14–16% or 22–25% less than in 2013, respectively.

As of today, of the 93 officially operating state-owned mines only 24 are actually operating. All of them are located outside the territories of military operations. 62 mines pump water and 7 mines have been completely destroyed.

Rinat Akhmetov’s DTEK Holding is also calculating its losses. The press service of the company reported that it managed to avoid complete destruction of the mines, but coal production at two companies – the Komsomolets Donbasa and the Chervoniy Partyzan – has been temporarily suspended. “They will return to regular operation upon normalization of the situation in the east of Ukraine,” say representatives of DTEK.

As a result, in order to cover for the shortage of coal the company has been supplying fuel from its Rostov enterprise (Obukhovskaya mine) since August to meet the needs of the Luhansk TPP. In addition, it scaled down exports of anthracite types of coal and redirected all anthracite to the domestic market. At the same time, DTEK plans to maintain the volumes of exports of coal from the gas group at the average annual rate by the end of the year.

Particularities

The distinctive feature of Ukraine’s coal industry is that converting coal lies in the fact that domestic power plants are designed for burning different types of coal. 7 of 14 thermal power plants in Ukraine are designed to burn highly reactive coal of gas brand G (Zuyev, Vuhlehorsk, Zaporizhzhya, Kurakhove, Ladyzhyn, Dobrotvir and Burshtyn TPPs); 6 TPPs are designed for burning low-carbon A and T coal brands (Trypillya, Zmiyiv, Prydniprovska, Starobeshiv, Slovyansk and Luhansk TPPs), while the TPP in Kriviy Rih is designed to operate exclusively on T brand coal.

The problem is that the 24 currently operating state-owned mines mainly produce G brand coal and there is a shortage of A and T brands. “Most mines producing A and T coal are located in the towns of Shakhtarsk, Krasniy Luch, Antratsyt, Rovenky and Sverdlovsk in the Luhansk oblast, which are controlled by the separatists,” said Vivcharenko.

There are no deficit brands in the Lviv-Volyn coal basin either (its recoverable reserves are estimated at 155 mn t). During the first 9 months of 2014 western Ukrainian mines extracted to the surface 1.5 mn t of gas group coal (-32% compared to the same period last year) and transported the fuel to three nearby thermal power plants in Ladyzhyn, Dobrotvir and Burshtyn.

First Deputy Minister of Energy and Coal Industry of Ukraine Yuriy Zyukov says under the current circumstances we have to buy anthracite coal in other countries “until the situation in the east of Ukraine is stabilized and we resume operation of mines that extract anthracite”.

Question…

Will the authorities resume operations at these mines? Is it necessary? The government intends to answer these questions negatively.

Officials of the corresponding ministry prepared a draft regulation of the Cabinet of Ministers “On Elimination of Unprofitable Coal Mining Companies that Suspended Operation due to the Combats on the Territory of the Donetsk and Luhansk Oblasts”. The document provides for the closure of 14 coal enterprises, as “they are highly unprofitable and their renewal and continued production is not expedient”. The list includes two mines of the state enterprises DUEK, one mine of the Shakhtarskantratsyt, the Torezantratsyt Mine Administration, three mines of Luhanskvuhillya, three mines of Pervomaiskvuhillya, two mines of Lysychanskvuhillya and two mines of Donbasantratsyt. The losses from production and business operations of these mines in the first half of 2014 amounted to UAH 792.8 mn.

As it was stated in the explanatory note to the draft resolution, the cost of closing of the aforementioned mines is approximately UAH 2.02 bn and the term of closure – 18–36 months. “At the same time, over the next three years budgetary savings through the adoption of the draft resolution will amount to UAH 2.03 bn and starting from 2018 – at least UAH 1.350 bn annually. “This will optimize the structure of the coal industry and improve the efficiency of coal enterprises.

Trade unions are strongly against the shutting down of mines. For example, the Lysychansk Territorial Committee of the Trade Union of Coal Industry Workers said the decision to close the mines of LysychanskVuhillya was hasty and ungrounded, since the mines have suspended production for only four days (July 22–25) during the regional hostilities. Now their operation has been suspended artificially to save costs of the payroll (some miners were sent on unpaid leaves). However, industrial reserves of coal at the Novodruzhesk mine are 35 mn t and at the Privilna mine – approximately 43 mn t. Besides that, both mines are working on preparation of new longwalls with a daily load of 300 t and 700 t, respectively.

Today, trade unions are holding talks with the Ministry of Energy and Coal Industry to save the mines that have been shut down. But it seems that officials in high ministerial offices are serious about restructuring the coal industry. “For now we are resolving the current problems, but there is a pressing need for reforms in the coal industry”, said Vivcharenko, who is indignant about the growing amounts of budget financing for the loss-making industry.

For instance in 2010 the subsidies for coverage of the difference between production costs and sale prices at state-owned mines were UAH 7.2 bn, while in 2013 the government spent UAH 13 bn for this purpose. Moreover, the volume of extraction of coal over this period decreased (from 38.4 mn t to 24.2 mn t). It appears that for the last three years subsidies for each ton of coal mined by the state have increased by almost three times (up to UAH 537.2). Analysts estimated that based on results of this year subsidies for the coal industry had all the chances of exceeding UAH 16 bn (the calculations are made on the basis of results of the relatively peaceful first quarter of 2014 with subsidies for this period amounting to approximately UAH 4 bn).

“Our government cannot finance and provide for the coal industry”, says Vivcharenko, explaining that there are state-owned enterprises in the industry, where the production cost of 1 t of coal is close to UAH 7,000–10,000, while its sale price is UAH 700 per t. “In the process of shutdown of such highly loss-making mines we will take into consideration the balance reserves of coal”, says Vivcharenko. “Currently, some improvements and last adjustments have been made to the program of restructuring of the coal industry”. Representatives of the Ministry of Energy and Coal Industry plan to develop 35–40 of the most promising state-owned mines (with their subsequent privatization), 26–30 mines will be preserved (with the possibility of resuming of production in the future) and 29 mines will be shut down.

Terms

Despite this, analysts do not consider the restructuring of the coal industry as reform. “Instead of reforms we will witness an outright shutdown of unprofitable mines,” says Korolchuk. Furthermore, nobody anticipates the successful privatization or attraction of foreign capital to the domestic coal industry. “Today, foreign investors are taking a wait-and-see position with regard to Ukraine,” says Managing Director at the Energy Resources of Ukraine Andriy Favorov.

It is also difficult to lure investors to Ukraine’s coal mining industry as the geological conditions do not allow classifying domestic coal as one of the sectors that is highly attractive for investment. “The considerable depth of mining, the high explosion hazard due to methane emissions, the small thickness of layers and the large number of steep formations (i.e. located at a high angle to the horizon) increase production costs and reduce the investment attractiveness of the industry in general,” says Director of Ukrpromzovnishekspertyza Volodymyr Vlasyuk. Moreover, in recent years new fields have been explored all over the world (Mongolia, Mozambique, Indonesia), which in their natural conditions are far superior compared to the conditions in the Donbas region. Major new coal projects are being developed in those countries.

Ukraine is doomed to import coal from similar regions in the world that are already developed and are developing. Deputy Head of the Department for Industrial Resources at Derzhzovnіshіnform Oleksiy Shevtsov says that in theory Ukraine could also supply power generating coal from Poland, Colombia, the U.S., Australia, Indonesia, Vietnam and Russia. Favorov believes that in terms of the ratio of the purchase price and the cost of logistics Russian coal is the most attractive.

Amounts involved

One can only guess the price of coal from South Africa, which is expected to arrive in the nearest days. The government has not published any figures yet. Industry analysts decided to calculate the price of imported fuel based on spot quotations for South African coal with a calorific capacity of 6,000 Kcal per kg in the Richards Bay and payment on FOB terms. “If the coal arrives in mid-October, this means it was contracted in early September and at that time it was worth approximately US $68–69 per ton. Now, it is priced at US $66 per ton,” says Head of the Analytical Department of the Ukrpromzovnishekspertyza state enterprise Oleksandr Krainikov, suggesting that the freight to the Pivdenniy port will be at least US $25 per ton. “Supposing the coal was purchased a bit later (mid-September for delivery in October), the price will be US $1–2 lower per ton,” suggests the analyst. This is nearly equal to the average production cost of Ukrainian coal mining.

Korolchuk’s figure is slightly higher – US $110–120 per ton, because in addition to freight the expert included other fees in the price, such as VAT and the cost of delivery to power stations. This result is equal to the average cost of Ukrainian coal – UAH 1,500–1,650 per ton, including subsidies, salaries, social payments to miners and cost of delivery to consumers.

As for global prices of power generating coal, this year they are showing a “sideway trend and relatively weak downward trend the recently appeared”, analysts say. This is due to the moderate demand of key customers in Europe and Asia. “Ukraine’s entrance as a buyer of power generating coal has thus far not had a significant impact on world quotations,” said Shevtsov. “In particular, quotations on South African coal in August – September 2014 decreased by an average of 6–8% and coal exported from Baltic ports (Poland, Russia) - by 5–6%”.

Analysts point out that world prices tend to vary slightly due to seasonal factors, but the rise in the price of coal will not be dramatic, but rather moderate. For example, in October South African coal cost UAH $66 for a ton, and by the end of 2014 the price could go up to US $69 for a ton. “On average, coal will be sold for US $68 per ton on the world market in 2015, at US $70–71 per ton in 2016 and for $72 – 74 per ton in 2017,” predicts Krainikov. However, the recent legislative initiatives in China may lead to significant adjustments to this forecast. Since October 15 the Finance Ministry of the PRC imposed duties on imports of power generating coal to protect domestic production. As a result, the supply of coal in other markets may rise and collapse its prices.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.