Economy

stagnationUkraine’s M&A market hit rock bottom

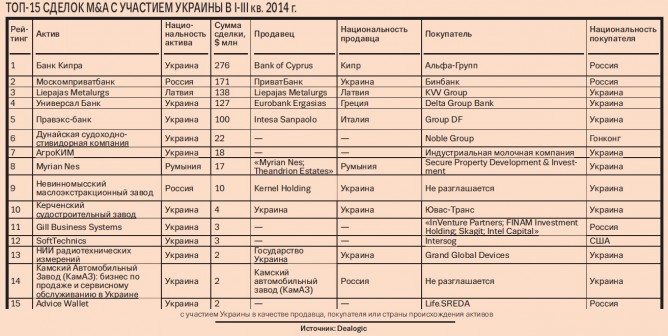

The M&A market in Ukraine has dropped to a level lower than during the global financial crisis and recession of the Ukrainian economy in 2009–2010. Over the last nine months there have been only 73 M&A transactions with Ukrainian buyers, sellers or assets, according to data of the international company Dealogic provided to Capital. For comparison, 331 transactions were made over three quarters of 2009. Since then, their numbers have been in decline with every passing year, reaching rock bottom this year.

The obvious reasons for this were the political instability caused by two snap elections held within one year and the ongoing hostilities in the eastern part of the country. “Most investors are waiting for stabilization of the political situation in Ukraine before investing,” said Head of the Corporate Finance and M&A Group at EY in Ukraine Vladyslav Ostapenko. The few deals that have been closed are either those that began a year ago or forced bargains.

Spoils of war or lap of luxury

Arrangements with Ukrainian IT startups can be classified as those that were planned a long time ago. For example, the manufacturer of mobile applications and games SoftTechnics from Odesa was acquired by the US-based Intersog. Ukrainian startup Advice Wallet, which developed an application with a customer loyalty program, sold a share to the Russian venture fund Life.SREDA in order to develop a mobile payments service for Settle institutions. Gill Business Systems, which developed the GillBus software program for the sale of bus tickets via the Internet and payment terminals, also attracted investments from the Russian venture capital funds InVenture Partners, Intel Capital and Finsight Ventures.

It is possible that the sales of businesses under the pressure of anti-Russian sentiments in Ukraine were forced, said Chairman of the Supervisory Board at MT-Invest, a specialized M&A market operator, and Vice President of the Ukrainian League of Industrialists and Entrepreneurs (ULIE) Myroslav Tabakharnyuk.

For example, the sale of a chain of 240 gas stations and 6 tank farm facilities on the balance of LUKOIL Ukraine by the Russian company LUKOIL to Austrian AMIC Energy Management. “After numerous cases of boycotting of its gas stations the Russian company carried out a technical transaction that will enable it to technically change the owner and re-brand,” says Tabakharnyuk. The amount of this transaction, not recorded in the statistics of Dealogic, is US $300 mn, which could make it the largest deal of the year on the M&A market with Ukrainian participation.

Due to the bad blood between Ukrainians and Russian producers in the midst of the war between the two countries, Russia’s Kama Automobile Plant (KamAZ) also sold its sales and servicing network in Ukraine.

Russian Rosgosstrakh also got rid of the Providna Insurance Company selling all its shares in the Ukrainian subsidiary to a consortium of investors in Western Europe. However, it is early to speak of the mass departure of Russian investors. “Rapid withdrawals mean going out of business at a lower price. Even if Russian companies actively leave Ukraine, this process will happen gradually and without panic,” said Tabakharnyuk.

The lack of alternative buyers becomes another “stick” for forced transactions in Ukraine. In particular, having failed to find a buyer, the Concorde Capital Investment Company together with shareholder of the Luxoptica chain of optician stores Oleh Kalashnikov purchased 80% of the Dobrobut chain of clinics.

Sold for peanuts

Shallowing of the segment had an even more pronounced effect on the number of deals. Last year the Ukrainian market kept pace with the global market. The increase in the number of transactions with Ukrainian participation more than doubled in 2013 after a three-year decline. They were mainly deals with Ukrainian assets, the sale of which has quickened due to the replacement of foreign owners of local assets with Ukrainian owners and the consolidation of domestic business.

But in 2014 even the desire of foreign investors to leave Ukraine almost did not keep the market afloat. Due to the lack of demand for local assets in three quarters the average transaction value with Ukrainian participation fell by half to US $12 mn compared to the same period last year. In general, the M&A market with domestic buyers, sellers or assets lost three quarters of the volume, having fallen to US $895 mn in the nine months.

The general decline on the market and the average transaction amount was due to the increased application of “reduction factors” to asset value, given the crisis situation in the country. “Before the crisis, the multiplier to EBITDA (ratio of the cost of a company to its pre-tax profits – Capital) was 8–10. Today, it has fallen to 2–4,” says Tabakharnyuk.

Man-made obstacles

While before the autumn the M&A market with Ukrainian assets fell due to market factors, in September administrative restrictions had their effect. On September 23, the NBU imposed a restriction on the return of funds received by foreign investors as a result of the sale of Ukrainian securities outside stock exchanges (with the exception of government bonds), as well as the corporate rights of legal entities not confirmed of owning shares in foreign currency abroad. This was done to stop the outflow of hard currency from the country caused by the fact that foreign investors pulled out.

Over the past year the country lost US $2.6 bn in foreign investments that previously fed Ukraine’s economy, mainly because of the withdrawal of European bank groups – the Austrian Erste Group, the Swedish Swedbank, the French Societe Generale, the Greek Alpha Bank, as well as the Cyprus Fintest Holding Ltd and Kalouma Holdings Ltd, which owned the Kredytprombank. The Ukrainian economy lost another US $6.8 bn or 90% of direct foreign investments in the first half of this year that were brought into the country over the past two years.

Those few deals that were in the process of being concluded have been frozen as a result of restrictions of the NBU. For example, the NBU did not approve the sale of UniversalBank by the Greek Eurobank Ergasias to Ukraine’s Delta Group Bank owned by Mykola Lahun. According to the agreement reached by the banks in August, the expected amount of the deal planned to be reached by the end of 2014 was €95 mn. Moreover, according to Managing Director of Dragon Capital Dmytro Tarabakin, a similar restriction on the movement of capital in currency obstructs entrance and withdrawal of companies from the Ukrainian market. “Transactions that were already underway at the time when the restrictions were introduced were for the most part not frozen. But some investors that were seeking an opportunity to enter or withdraw from the market simply chose to pull out, which, in general, led to a decrease in business activity in the M&A sector in Ukraine,” says the investment banker. During the first three weeks of October only three deals with Ukrainian companies were announced. At this rate, in the Q4 2014 the M&A market will hit a record low.

Incentive package

Despite this, the NBU is preparing to lift restrictions on the sale of Ukrainian assets by foreign investors in the near future. This is imperative as the central bank plans to encourage consolidation in the banking sector. In November it plans to submit a bill to the newly elected parliament providing for simplification of procedures of mergers and acquisitions of banks in order to facilitate the process of consolidation in the banking sector, said First Deputy Governor of the NBU Oleksandr Pisaruk.

Speaking of consolidation, the central bank does mean so much the consolidation of sound banks through mergers and acquisitions, as the purchase of troubled financial institutions by those that are showing high performance indicators. In mid-September Pisaruk promised that the number of supervisors in banks, including those for which temporary administrations were introduced, will increase from 28 to 36–37. Many of them are potential candidates for sale as most financial institutions are too small for the government to spend money on their capitalization and recovery.

“In any case it is necessary to simplify procedures, as this would increase the chances of attracting investors,” says Tarabakin. However, regardless of the simplicity of the M&A procedures in the near future it will be difficult to find investors for banks and other Ukrainian assets.

Ostapenko believes that the M&A market in Ukraine can be revived by three factors: first of all, the desire to sell companies due to the fact that they are uncontrollable because of the change of the political elite. Secondly, the willingness to buy Ukrainian assets that have hit “rock bottom” and include them in the asset lists in anticipation of further growth owing to new political, economic and other trends, as well as the prospects of integration with the EU. The third factor is the ability of stable Ukrainian companies to obtain additional financing and use it for mergers and acquisitions and further systematic growth.

Nevertheless, such factors will not bring results any time soon. Tabakharnyuk notes that almost a year will pass from the time when the war is over and political stability is restored before buyers of Ukrainian assets return to the market and deals will be made. This means that the recovery of Ukraine’s M&A market should not be expected sooner than the end of 2015.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.