Business

redistributionHryvnia devaluation is a blessing in disguise for Ukrainian pharmaceutical companies

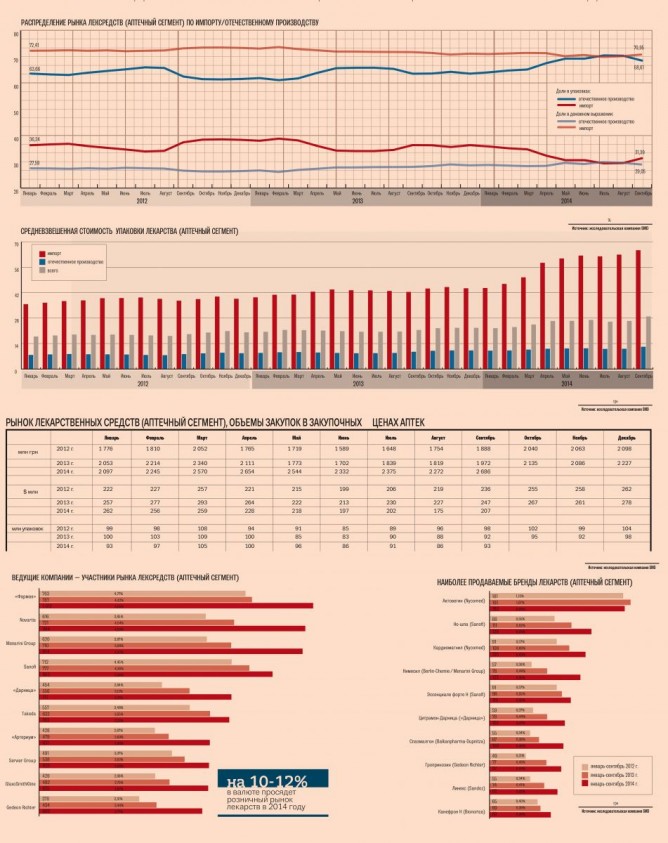

Ukrainian pharmaceutical companies are succeeding in winning back the domestic market from importers one step at a time. In January–September Ukrainian pharmacies sold 848.5 mn packages of medicines in the amount of UAH 21.8 bn. Ukrainian medications account for 29.1%, which is by 1.6 p.p. more than over the same period last year. In terms of packages, the share of local pharmacists grew by 3.9 p.p. – to 67.8%.

Substituting importers

Director of the Department of External Relations of the STADA CIS Pharmaceutical Holding Ivan Hlushkov says the growth of sales of medications produced by Ukrainian manufacturers is not their merit. In terms of devaluation, even if they did not do anything to promote their products, the share of Ukrainian drugs still would have grown.

In January-September two of the three Ukrainian pharmaceutical companies were able to strengthen their positions in the retail segment of the market, according to Support in Market Development (SMD). For example, Darnytsia moved in the rating of the largest sellers of medicinal products from seventh to the fifth place, Arterium – from tenth to seventh place and Farmak managed to retain its number one position on the market.

The prices of imported medications increased due to devaluation of the hryvnia, which means the demand has shifted to cheaper Ukrainian analogs. “People do not have money. Seeing as pensions and salaries were frozen, average Ukrainians cannot afford to buy expensive foreign medications,” says market expert Svitlana Bunina.

Over the period September 2013 to September 2014, the price of one conventional package of medicinal products increased by 34.6%, according to SMD. Ukrainian pharmaceutical companies gladly welcomed their performance results. “In terms of packages the growth of 5 p.p. is a great success for Ukraine’s pharmaceutical industry, because this means that another 5% of physicians prescribe our products and patients receive effective treatment,” believes Advisor to the General Director of the Darnytsia pharmaceutical company Andriy Myronyuk. In previous years, according to SMD, the fluctuations of shares did not exceed 0.5 – 1%, with the exception of the crisis in 2009.

Deputy Director of SMD Yevhen Zhyvodyornikov explains the slight increase of the share of Ukrainian players on the pharmaceutical market in monetary terms saying that the prices of imported drugs increased more than the prices of Ukrainian products. In January–September the price of a conventional imported package of drugs increased by 54%, while the price of a domestic package increased by only 29%.

Noteworthy is that Ukrainian medications depend on imported raw materials, so their prices were automatically affected by devaluation of the national currency. The share of imported components in the cost structure of Ukrainian medicines is approximately 20%, according to estimates of General Director of the Ukrainian pharmaceutical company Lekkhim Tetyana Pechayeva.

Also worth noting is that in the Top 10 best-selling brands of medicines Ukrainian enterprises are represented only by Citramonum-Darnytsia , which is in sixth place in the ranking for the second year in a row.

All for growth

In proportion to the stabilization of prices, the share of domestic products in monetary terms will continue to grow, says Zhyvodyornikov. But there will be no rapid increase in sales of drugs in packages, since the substitution process is almost complete. “There is no prospect for further growth of the share of domestic products, as already three of the four sold medications are Ukrainian,” says Executive Director of the Pharmaceutical Association of Ukraine Viktor Chumak.

Importers will be able to win their positions back due to active promotion of cough and cold medications, assumes Zhyvodyornikov. He explains that Ukrainian players are weaker when it comes to marketing programs.

At the same time, Ukrainian producers have not yet exhausted their potential. Chumak says approximately 30% of the imported product range has no analogs among Ukrainian medications. Hlushkov provides an example of the Russian market, which is structurally very similar to the Ukrainian market. There almost half of the drugs for treatment of respiratory and cardiovascular diseases are imported. There is a more critical situation in the groups of medications used for treatment of the genitourinary system, as well as hormones, 70% of which are imported. Bunina says other most promising segments for domestic manufacturers of pharmaceuticals are hypoglycemic and endocrine drugs and medications for the treatment of cancer and tuberculosis.

Lobbying will help

Over the next two years the working conditions of foreign pharmaceutical manufacturers on the Ukrainian market of medicinal products will become more complicated, says Director of the Medical Marketing Agency Yuriy Chertkov. This is stipulated by the arrival of a powerful lobby of Ukrainian pharmacists in the parliament, in particular, the election of General Director of the Darnytsia pharmaceuticals company Hlib Zahora to the parliament on the party list of the Petro Poroshenko Bloc, he explains. “This candidate has high chances of chairing the VR Healthcare Committee,” said the expert. He predicts that MPs representing the pharmaceutical business will initiate changes in legislation to toughen the terms of registration of foreign medications, get into public procurement and reformat the mandatory list of the range of pharmacies in favor of domestic products.

In order to increase the share of domestic products on the Ukrainian market of pharmaceutical drugs the government should resort to administrative measures, which have an impact on importers, believes Chairman of the Union of Consumers of Healthcare Services, Pharmaceuticals and Medical Products Vladyslav Onyshchenko. He says importers should be given a stimulus to produce medications at Ukrainian pharmaceutical companies, which have the capacities to produce almost all types of drugs and have certificates of compliance with GMP standards. This will contribute to the loading of capacities at Ukrainian pharmaceutical companies and a substantial reduction in prices of imported medicines. “At present, medicines produced at Ukrainian plants are four times cheaper than their foreign analogs, meaning that there is plenty of room for lowering prices,” assured the expert.

Zhyvodyornikov predicts that in terms of hard currency the market will shrink by 10-12% in 2014 and growth will resume next year. Presuming that the hryvnia exchange rate stabilizes at UAH 13/US $, the market will grow by 2-3% in terms of foreign currency.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.