Finance

risksThe NBU is devising a new stress test for commercial banks

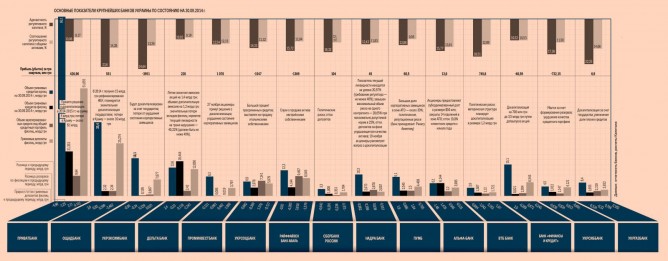

Given the deepening financial crisis, as well as the direct requirements of the IMF, this spring the National Bank of Ukraine (NBU) announced stress tests for the largest banks. To date, an analysis of the top 15 or the so-called system banks has been completed. The analysis was conducted on the basis of two forecasts – the basic and worst case scenarios. The basic scenario assumed an average exchange rate of the hryvnia this year at the level of UAH 10.80/USD and UAH 11/USD by the end of the year. The proportion of negatively classified assets was estimated at 12.9% for foreign currency loans for businesses and 55.9% for foreign currency loans for the population.

According to the worst expectations, the average annual exchange rate of the national currency was estimated at UAH 12.10/USD and by the end of the year – UAH 12.5/USD. For such indices the value of troubled debts was estimated at the rate of 18.8 – 70.6% of the loan portfolio. But in reality Ukrainian financial institutions did not manage to comply even with the parameters of the worst case scenario. Therefore, the central bank said it will conduct another stress test in 2015.

Things can be worse

The last three quarters of 2014 have been extremely difficult for Ukraine’s financial sector in general and the banking sector in particular. In the spring financial institutions sustained serious losses due to the annexation of Crimea after which many were forced to close their branches in the ATO zone. Due to the military operations in the east of the country Ukrainian banks lost almost UAH 60 bn, according to Minister of Finance Oleksandr Shlapak.

The war caused panic among the population. This aggravated devaluation of the national currency, which was more than 60% over 9 months of this year. The declining confidence in the banking system triggered a significant outflow of client funds. Although formally due to the revaluation of foreign currency deposits, the deposit portfolios of banks grew by 5% over the last three quarters of the year and the actual outflow reached the level of UAH 110 bn, says NBU Governor Valeria Hontareva.

As it was expected, the financial performance results of banks deteriorated significantly and their liquidity decreased due to limited access to external capital markets. According to the NBU, in January–September the banks lost UAH 10.6 bn, whereas over the first nine months in 2013 they showed profits of UAH 1.7 bn. The increase in the expenses of banks over nine months in 2014 exceeded growth in revenues by 10.8 p.p., while based on results of August the gap was 8.3 p.p. The reason is the increase in deductions to reserves, which in September alone grew by UAH 8.8 bn to UAH 53.6 bn.

The need for formation of reserves is primarily related to devaluation. When the hryvnia equivalent of currency loans grows, banks are forced to allocate more reserves. In addition, the need for additional reserves also arises from the decrease in the purchasing power of people, which in turn leads to an increase in debt arrears. Obstacles for business operations in the ATO zone, where the major industrial borrowers are located, also played a negative role. Today, the share of overdue payments of loans by more than 30 days exceeds 50% on those territories. According to the NBU, the overall share of bad debts increased from 7.7% at the beginning of the year to 11.5% at the beginning of October. But in fact, the actual level of overdue liabilities may reach 30% of the total portfolio of bank loans.

“The state-owned Ukreximbank became the leader in terms of unprofitability among the largest banks, according to the qualification of the NBU. In the first nine months of the year it reserved more than UAH 9 bn for its loan portfolio. As a result, its loss for the same period amounted to almost UAH 4 bn. Ukrsotsbank (Unicredit Bank) is second in terms of losses with a negative result of UAH 1.5 bn. The financial institution reserved UAH 2 bn for loans. The second European bank on the list of the largest in Ukraine – Raiffeisen Bank Aval – showed losses of UAH 1.4 bn and was forced to set aside UAH 3.4 bn in reserves.

Expenses of the banks also increased due to attempts to stop the outflow of deposits by raising interest rates. “The dynamics of the decrease in net profits was due to the growth in the prices of resources, particularly, deposits of individuals. Their value rose to 23% in local currency, 11.5% - in foreign currency, which reduces net interest revenues” said Head of the Press Service of Privat Bank Oleh Serha.

Black holes

The stress test, which took into account the performance of financial institutions as of January 1, 2014, revealed that the country’s leading banks were short of UAH 66 bn in terms of capital. Nine system banks, with the exception of PUMB, Alfa Bank, Sberbank of Russia and Raiffeisen Bank Aval, should be capitalized by UAH 56 bn, while 17 of the largest banks need only UAH 10 bn. In this case the owners of the banks are allowed to fund their institutions over a few months. Next week the recapitalization program should be coordinated between the banks’ shareholders and the central bank of Ukraine.

In order to encourage shareholders to invest money into financial institutions the NBU even promised certain preferences for banks, which increased their regulatory capital by at least 20% by the end of 2015 and submitted to the regulator their financial recovery program until 2018. In its decree No. 602 issued in September, the NBU reported that it would be willing to mitigate the terms for refinancing issued to such banks, namely the rates, the debt repayment schedule and the list of collateral for loans.

As it was previously reported by First Deputy Governor of the NBU Oleksandr Pisaruk, the country needs UAH 12.5 bn for recapitalization of the largest state-owned financial institutions and most of the amount will be used to support Oschadbank, which needs recapitalization due to its losses in Crimea. “The bank was taken over by individuals that are controlled by Russia. The raid resulted in expropriation of the entire network of branch offices, assets and property, specifically, armored vehicles and ATMs,” said Chairman of the Board Andriy Pyshniy. Oschadbank estimated its losses at UAH 10 bn. The government will have to compensate for the damages.

Another UAH 20.6 bn is required for recapitalization of the largest banks with foreign capital, said Pisaruk. Most likely he referred to the Russian VTB Bank, Prominvestbank and the Italian Ukrsotsbank (UniCredit Bank). Earlier, Chairman of the Central Bank of Russia Elvira Nabiullina confirmed the readiness of her country to capitalize banks with Russian capital operating in Ukraine. In addition, the media reported that Russian hackers published materials of Vnesheconombank, according to which its Ukrainian subsidiary Prominvestbank needed a minimum capitalization of UAH 6.2 bn. The same sources stated that in the event the bank does not receive the money, Prominvestbank would go bankrupt at the beginning of 2015. Back in July the general meeting of shareholders of Russia’s VTB Bank also decided to capitalize its Ukrainian subsidiary in the amount of UAH 1.2 bn.

Some Ukrainian banks also reported on their plans for recapitalization. For example, in 2014 – 2015 Privat Bank will be recapitalized in the amount of UAH 4 bn. One of the reasons for the recapitalization of PrivatBank and Oschadbank is the annexation of Crimea, where the financial institutions lost virtually all of their property and assets. Back in March representatives of PrivatBank reported that the total amount of investments of the financial institution in the economy of the peninsula exceeded US $1 bn. PrivatBank invested more than US $300 bn in the development of the modern banking infrastructure in Crimea. On the peninsula the bank had two branches, 337 offices, 773 self-service terminals and 483 ATMs. The financial institutions provided another US $700 mn to Crimean companies and individuals as loans. The bank was also crippled by the outflow of deposits. In January-September account-holders withdrew more than UAH 9 bn from their hryvnia accounts. It is difficult to state an exact amount of withdrawals from foreign currency accounts due to the rising exchange rates.

On September 29 shareholders of Delta Bank also decided to increase the authorized capital of the financial institution by 31% (UAH 1.17 bn) to UAH 4.9 bn. The owners of the financial institution are obligated to contribute this amount by January 23, 2015. The bank’s need for the funds is obvious, as the adequacy of regulatory capital of Delta Bank is 10.2%, which is only slightly above the minimum level. Delta Bank already increased its share capital this year. On July 3, it completed the process of recapitalization in the amount of UAH 1.4 bn to UAH 3.7 bn by issuing additional shares.

Shareholders of Finance and Credit Bank announced the increase its capital by 25% to UAH 3.5 bn. At the same time, they already supported the financial institution this year by increasing the bank’s capital by 21.7% (UAH 500 mn) to UAH 2.8 bn in February 2014.

On November 19, the shareholders of Nadra Bank will consider recapitalization of the institution at its general meeting. According to official statements, the financial institution, which is one of the major banks in Ukraine, is not fulfilling a number of requirements to prudential standards according to the results of the 3rd quarter. For example, the current liquidity index of Nadra Bank is 20.87%, while the NBU requires that this index should be at least 40%. Also, the bank’s maximum amount of exposure per counterparty is too high – 28.65%, while the permissible level is 25%.

The smaller, the better

It is quite interesting that following the results of stress tests, the majority of banks in the second group are in a more favorable situation in terms of capital adequacy, even in comparison with the market leaders in the first group. There are several explanations for this, believes Chief of the Financial Sector Rating Department at IBI-Rating Anna Apostolova. One of them is the presence of a significant proportion of western European capital in the group (OTP Bank, Credit Agricole Bank and ING Bank Ukraine). Due to the fact that the parent companies of banks backed by European investments are subject to the requirements of Basel III (or the Third Basel Accord), the banks themselves are forced to make a more balanced assessment of their risks and have to be more responsible about backing such risks with sufficient amounts of capital. “Moreover, despite the impressive share of foreign currency loans in their portfolios, such financial institutions are less exposed to currency risks as they can count on the support of their parent companies,” said Apostolova.

Another feature inherent to the second group of banks backed by foreign and domestic capital is the significant proportion of loans issued to legal entities in their portfolios. Nevertheless, this factor has a certain risk of concentration, which slightly increases the exposure to credit risk, says Apostolova. At the same time, the relatively high diversification of funding base allows the banks to maintain acceptable levels of liquidity.

Assessment of the amount required for recapitalization of each individual bank requires a customized approach and should take into account all the factors affecting is operations directly or indirectly, notes Apostolova. Financial institutions that are most actively engaged in retail unsecured lending are in the same high-risk zone. Today, more than 30% of such loans are troubled and in the mid-term this rate will only increase, believes Advisor to the Chairman of Eurobank Vasyl Nevmerzhytskiy. The considerable growth in arrears and the outflow of deposits erode liquidity.

Some banks in the NBU’s second group have also reported their readiness for recapitalization. For example, Chairman of Universal Bank Ihor Volokh confirmed that based on results of the stress test the financial institution needed a slight increase in capital that would be provided by its parent structure – Greek Eurobank Group. On November 3, the general meeting of shareholders of Universal Bank decided to increase the authorized capital of the institution by UAH 500 mn. On November 27, the meeting of shareholders of Khreschatyk Bank will approve a decision to increase its share capital by 66.4% (UAH 550 mn) to UAH 1.379 bn.

On November 17, the general meeting of shareholders of VAB Bank will also consider the possibility of increasing its authorized capital by UAH 7 bn to UAH 11.04 bn. Earlier, the bank’s owner Oleh Bakhmatyuk stated he was unable to provide the full amount and would turn to the Finance Ministry for assistance in the capitalization of bank in the amount of UAH 4 bn.

However, even if all the banks invest in their capital as much money as is required based on the results of the stress test, this does not mean that the situation in the Ukrainian banking system will improve significantly. Even such big money will not solve all the problems. After all, the worst scenario of the stress test was geared towards an exchange rate of UAH 12.50/USD. Yesterday, the NBU official rate was UAH 13.50/USD. Moreover, financial institutions have not written off their losses in Crimea and the ATO zone from their balance sheets, which are approximately UAH 60 bn. These new factors will be taken into account in another stress test that the NBU is preparing for the next year. The amount to be additionally entered by bank owners and the government will be calculated based on the results of this test.

Що стоїть за показниками про прибутки банку (чому станом на сьогодні Приватбанк з прибутками, а Укрсоцбанк зі збитками), чи можна збитки штучно збільшити або зменшити, як відображається в обліку безнадійна заборгованість банків і т.і. Псевдонаукові пропозиції експертів-лобістів опубліковані в Інтернеті і, здається, лише я опонент таким статтям. Чого варті статті щодо необхідності відміни мораторію, який, наразі, є єдиною надією позичальників, яким банк штучно збільшив борг і намагається відібрати єдине житло, знов таки, штучно зменшивши вартість житла. Я особисто був присутній на таких судових процесах та при діях державних виконавців, коли позичальник грабувався та принижувався під прикриттям авторитету держави. Таких позичальників змішують з позичальниками шахрайськими бізнес-структурами, кажучи, що всі позичальники бажали і бажають "кинуть банк". Виникає питання: "Совість є чи вона продана?" При цьому, серед коментарів до таких псевдонаукових статей, з'являються відверто грубі та провокативні. Наприклад, "почему я должен своим депозитом решать чьи-то проблемы", "надо быть дебилом чтобы взять кредит и еще большим дебилом, чтобы взять кредит в долларах", "валютные заемщики хотели меньших процентов, а теперь плачут", є і відверто грубі коментарі з ненормативною лексікою. Також з'являються коментарі мов би у підтримку позичальників зі скандальними політичними заявами, антисемітизмом і всім іншім, що дратує владу та нормальну людину. Такі коментарі я розцінюю, як замовні, щоб штучно маргіналізувати портрет позичальника та осіб, які йому співчувають. Це так, коротко про один з механізмів заговорення трагедії кредитного рабства. Хто творець та двигун такого механізму? Кому це вигідно, той, напевно, і творець, і двигун.

Механізми звільнення від кредитного рабства є, вони обгрунтовані і навіть втілені в законопроектах, але банки бажають свободи дій в цьому процесі і блокують через лобістів всі ініціативи щодо полегшення долі позичальників. Доходить до цинізму, коли банки пропонують полегшувати долю позичальників тільки через участь в АТО. Герої зостануться героями, але тут слід зауважити, що в АТО-війні бере участь вся країна і кожен на своєму відповідальному місці. Навіть мама, яка на соціальній допомозі годує дитину, робить значний внесок в успіх нашої країни. Під тиском банківського лобі, влада опиняється в позиції нерішучих російських царів, які лили сльози над бідами кріпаків, але пасували перед привілеями поміщиків. Доки думали, то і кріпосне право було відмінене в Російській імперії трохи раніше звільнення чорношкірих рабів в південних штатах Америки, що, власне, і призвело до відставання імперії і її падіння під час революції. Коли до влади в Україні прийде другий А.Лінкольн, який волю свого народу поставив вище ніж амбіції рабовласників?

Може відкриємо ринок для банків Європи? Тільки не через продаж недолугого українського банку європейському банку (приклади: Аваль, Укрсоцбанк), адже капітал, традиції і персонал такого українського банку склалися в буремні 90-ті, тобто в ті часи, коли зароблявся той самий мільйон, про який воліють не згадувати.

Амбіції українських банків щодо примушування позичальників платити на старих умовах, особливо це стосується валютних позичальників, схожі на амбіції рабовласницької злочинної партії, яка спочатку бажала загарбати весь світ, потім лише Європу, потім амбіції звузилися до збереження контролю над власною розореною країною та пакуванням мішків награбованим добром, потім амбіції звузилися до збереження контролю над столицею власної країни, потім члени такої партії боролися за власне життя, потім за достойний ухід з життя і так далі. Банки, треба чути людей! Любіть людей і будьте з ними чесними!

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.