Economy

signalsA new turn of devaluation will provoke price growth

Yesterday, the National Bank of Ukraine lowered the hryvnia exchange rate against US dollar to a new historic low of UAH 13.95/US $1. It took the central bank two months to renew the low record of the national currency – on August 27 the hryvnia fell to UAH 13.89/US $1.

This time, the exchange rate was shaken up by the auctions, which the NBU decided to hold in a new format starting from November 6. Based on the results of the last two auctions, selling there the total amount of up to US $5 mn, the NBU determines the so-called indicative rate. On the day following after the auction, the banks can set buy/sell rates with a 5% deviation from the indicative rate. Therefore one can guess a day in advance what the rate at the currency exchange points will be on the next day.

The second day of the auction hasn’t provided any reasons to hope for stabilization as over two days the national currency devaluated by UAH 1. Yesterday, the banks set the rate for selling dollars at around UAH 14.2/USD at their exchange points. Along with the official rate the hryvnia also plunged on the black market, where a dollar costs around UAH 15.

Time is money

Despite the first results of the new trading sessions that caused hryvnia weakening bankers are cautious about drawing premature conclusions and are not hurrying to make forecasts. “There may be a growth trend. The next step, however, is to optimize the rate to the value, which would make it beneficial for exporters to bring hard currency into the country,” says Chairman of the Board of Ukrgazbank Serhiy Mamedov. For the time being, the exporters have taken a waiting position, he says. Furthermore, the importers are also not hurrying to make purchases understanding that the rate of UAH 14/USD and higher is unsubstantiated for them to perform transactions, noted Mamedov. “Right now, everybody is revising their plans for the purchase of currency. We are observing shrinking of demand,” he added. At that, there is a demand for currency in retail, which the banks cannot satisfy, since the auctions for supporting the bank counters and small transactions on the interbank exchange have stopped.

The hopes are being placed with exporters. Many of them, looking up at the new rate, are ready to appear with currency supply in legal transactions, says Senior Advisor of Alfa-Bank Roman Shpek. “Sooner or later this will happen. The hryvnia will strengthen. However, it is also not worth expecting that the dollar will weaken only thanks to the increase of trading at the interbank exchange as it is strengthening all around the world. A currency is strong not only for its reserves, but also for the condition of the economy and investment climate,” said Shpek. Meanwhile, there are no reasons so far for the strengthening of the national currency, believes President of the Ukrainian Financial Analysts Community Yuriy Prozorov. First of all the situation in the Donbas, which, as many had hoped, would be resolved after the presidential elections, poses a great obstacle for that, said the expert.

Putting pressure on prices

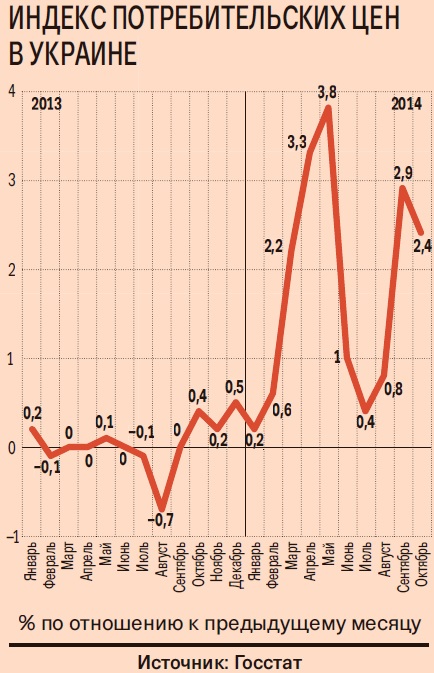

Due to the weakening of the hryvnia, the risks of a new wave of inflation are increasing. There is a probability that based on the results of the year prices will grow more than the government had forecast. In the period of January-September, the consumer price growth reached 19%, the State Statistics Service reported yesterday. This indicator was actually expected for the whole year. Growth of consumer prices since the start of the year has been reaching records of recent years approaching the indicators of the crisis year of 2008 based on the results of 12 months. Taking into account the latest data of the SSS, there is a possibility that the growth of consumer prices in 2014 will reach its high over the past five, if not ten, years.

Based on the results of October the inflation index grew 2.4%, while in September it was 2.8%. “Even not taking into account the change of the rate, September is the peak month for price growth and after that we usually observe a decrease due to the seasonal factor,” says Analyst of the International Center for Policy Studies (ICPS) Oleksandr Zholud.

The current weakening of the hryvnia will not largely affect the prices, believes Zholud. “Since the importers had problems with the purchase of dollars on the official market they purchased them on the black market and did so back in October. The rate on the black market was the same as the one the NBU just set. Therefore the high rate was already fixed into the prices,” says the expert. However, in case of further devaluation price growth is inevitable. The ICPS predicts that based on the year’s results inflation could reach 22-24%.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.