Business

reductionNearly half of Ukrainian retail chains may see a change of owners within a year

Food retailers are trying to minimize the risks of operation in the Donbas region with the help of the Chamber of Commerce and Industry (CCI). A force majeure certificate issued by the CCI permits temporary non-fulfillment of obligations to a contractor, for example not paying suppliers for delivered goods, says Director of the Ukrainian Retail Chain Suppliers Association Oleksiy Doroshenko. The deferral remains in effect until the decree of President Petro Poroshenko is issued on the completion of the anti-terrorist operations (ATO) in the east of the country.

Over the period from April-November of 2014, the CCI received over 4,000 applications for force majeure certificates and around 1,500 of them were issued, says CCI Vice President Mykhailo Nepran. “Over the same period last year, we received around 100 applications for the confirmation of force majeure circumstances. They mainly were submitted by agrarians and companies working with foreign contractors,” he specified. He says that around 58% of the total number of applications this year concerns the deferral of tax payments. Another 35% concern the deferral of fulfillment of obligations, which means that one of the parties requests confirmation of force majeure circumstances in order to avoid paying penalties under the contract. The certificates are being requested by different organizations that conduct business in the Donbas region, noted Nepran. However, managing partner of the Retainet consulting company Oleksandr Lanetskiy points out that the majority of businesses located in the ATO zone are food stores.

Temporary timeout

Retailers reluctantly speak about business problems they experience in the Donbas region. Furshet submitted documents to the CCI for obtaining of the certificate, the chain’s co-owner Ihor Balenko said. “Two of our stores in Luhansk and Horlivka (territories that are not controlled by the Ukrainian army – Capital) were destroyed by shell bombing,” he explained, adding that the company tried to defer loan payments by submitting this document. The property of the stores served as a collateral for banks, but the insurance company refused to extend the agreement with the retailer on these outlets. “We haven’t yet received a certificate from the CCI,” confirmed Balenko.

Also, suppliers appealed to the Chamber of Commerce and Industry. Director of the Vitis Group distribution company Serhiy Mazur says the certificate is required to avoid fines for failing to supply goods to stores located on territories that are not controlled by the Ukrainian authorities. “The sanctions are specified in our contracts with the retailer,” he explains.

Business optimization

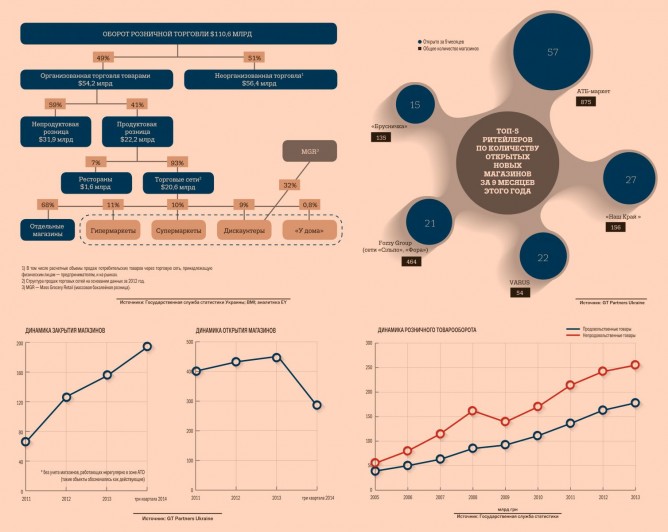

Food chains are trying to obtain certificates in order to minimize their losses. The situation in the food retail segment is at the moment quite difficult. “People’s purchasing power is rapidly declining, which is reflected in the financial indicators of retailers,” says Lanetskiy. Over nine months of 2014, the turnover in national currency grew by 5-7%, according to co-owner of food chain Tavriya-B Borys Muzalev. Prices grew 20-30% over the same period. Consumers are switching to cheaper products and steering away from buying more expensive imported goods. “The problem is that retailers earned most of their money on imported goods,” the expert claims.

Stores are being shut down

The situation is further aggravated by loans that companies took out from banks for developing their business in the pre-crisis years. The period of loan restructuring has long passed and now, being pressured by creditors, the players on the market are trying to optimize their business. Over nine months, 194 chain stores were shut down in Ukraine, while in the same period last year this figure was 133, according to data of GT Partners Ukraine. “We did not take into account the stores located in the ATO zone,” said the company’s director Ihor Huhlya.

As Capital wrote, Furshet, Varus, METRO, Amstor and other chains closed their retail outlets on the territories not controlled by the Ukrainian authorities. Many stores were destroyed. For example, the press service of the Amstor chain informed that stores in Yenakiyevo and Yasynovata were plundered, a supermarket of the chain in the Kuybyshevskiy District in Donetsk was shelled at the beginning of October, a store in the Petrovskiy District was partially destroyed in August and a shell hit the store in the Kyivskiy District. “Today, all Amstor stores work except for the one in Yasynovata,” the company’s press service reported.

ATB was the unlucky one. CEO and General Director of the ATB Corporation Borys Markov says one-fourth of the chain’s stores were located in the Luhansk and Donetsk oblasts before the start of the conflict. Today, 67 ATB stores continue to operate in the region, five of which are located in the ATO zone. He noted that 147 stores were seized by members of the DPR and LPR. “25 stores are currently operational. In the Luhansk oblast the representatives of LPR manage six stores, five were opened under the name Narodniy in Luhansk and one with an old sign is operating in the city of Antratsyt,” says Markov, adding that the new owners are mainly selling the leftovers of ATB products. As Capital wrote earlier, around 160 retail outlets closed in the Donbas since the start of the year.

Consolidation is around the corner

The pace of the growth of retail chains is also in decline. According to GT Partners Ukraine, 279 new stores were opened in Ukraine over the period January-October 2014, while 295 opened over the same period last year. Lanetskiy explains that this year the retailers opened those outlets that were planned in the previous peaceful years.

Over the year, around half of the retail chains operating in Ukraine will change their owners, predicts Lanetskiy. Consolidation of the market will take two-three years, believes Acting Chair of the Anti-Monopoly Committee Mykhailo Barash, adding that several large chains will concentrate the larger part of the retail trade market over this period. “This trend is being observed in all countries. For instance in Denmark, the leaders account for over 80% of the market,” he concludes.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.