Finance

national financeThe National Bank of Ukraine is covering up the real volumes of hryvnia emission

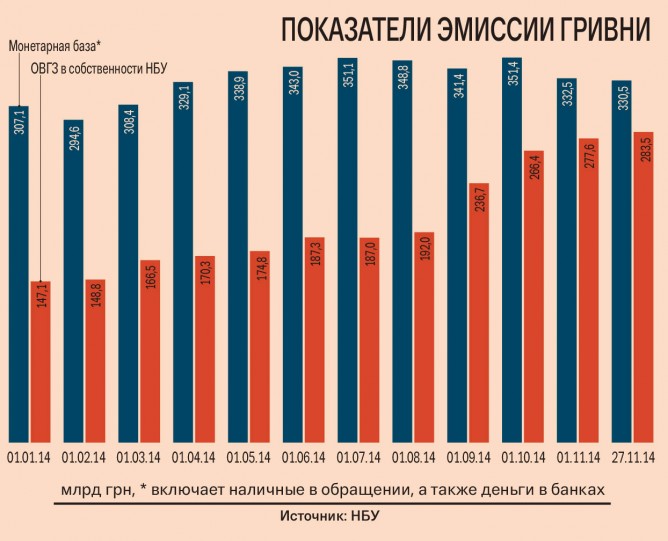

The National Bank of Ukraine denies that the emission of hryvnia in 2014 is out of control. Yesterday, the NBU informed that the monetary base since the start of the year grew UAH 23.4 bn (7.6%) to UAH 330.5 bn. Prior to that, some economists said the real emission over the year was UAH 200 bn. The NBU denies these figures, alluding to the growth indicator of the monetary base that is one of the indicators of emission.

“The procedure for the emission of money in Ukraine is strictly regulated. This is done exclusively by transfer of the corresponding sums in non-cash form to correspondent accounts of banks in the NBU. Conversely, when money is pulled out of circulation the corresponding amount is written off of those accounts,” the report of the NBU reads. Interestingly enough, the central bank decided keep silent about those factors that testify to larger emissions.

Turn on the mint

The indicator of the monetary base does not fully reflect the real situation with emission of money. “Money supply indicators do not reflect the market situation. Emissions could fully go to the hard currency market, which is what happened in Ukraine. They could also be deposited in banks. Given this, indicators can be totally different at equal volumes of emissions,” says First Vice Chairman of the Board of the Kontrakt bank Pavlo Krapivin.

Relying on the statistics of the monetary base, the NBU is not talking about the volumes of redemption of government bonds. Since the start of the year, the volume of government bonds in the portfolio of the NBU grew by UAH 139.9 bn. This is higher than in 2013, when the central bank accumulated UAH 41.4 bn in bonds (in 2012, this figure was only UAH 21.2 bn). The volumes of bonds purchased in 2014 are nothing but hidden emissions, say experts. “On the one hand, banks spend real hryvnia to buy bonds. On the other hand, they get refinancing from them, which means emissions. Moreover, the Ministry of Finance uses the funds from the sale of bonds to cover expenditures of the budget,” Krapivin explains.

A considerable part of the funds received by the government from the NBU from the sale of government bonds went to support the Pension Fund. However, Naftogaz of Ukraine received the lion’s share of this money to cover its debts and pay for gas, said economist Andriy Blinov. At the end of April, when the IMF approved the program of cooperation with Ukraine, it allowed the government to issue bonds for the capitalization of Naftogaz and the NBU to acquire them for UAH 23.662 bn.

After that Naftogaz was granted permission to buy US $2.15 bn from the reserves of the NBU in order to pay off its debts to Gazprom. In the end, the NBU received the hryvnia from Naftogaz for which it bought bonds from the Ministry of Finance. As a result of this vicious circle, the hryvnia is feeling the pressure: there is less hard currency and volumes of hryvnia are growing.

Besides that, money must be printed for the Deposit Guarantee Fund, which controls 31 banks since the start of 2014. In order to help with payouts to depositors, the Ministry of Finance should issue government bonds in the amount of UAH 10.1 bn. In order to support the fund and the central bank, the latter plans to provide the DGF a loan in the amount of UAH 6 bn in addition to the UAH 4.8 bn that the fund already received from the NBU.

Deja-vu effect

The NBU was forced to emissions in connection with the demand for the hryvnia. As Senior Analyst of the International Center for Policy Studies Oleksandr Zholud noted, this was incited by the major withdrawal of deposits from banks. Over ten months depositors withdrew UAH 53 bn from banks. In order to support the liquidity of banks, the NBU was forced to issue large sums of money for refinancing. For this reason, it is not surprising that since the start of the year the volume of cash in the country grew by UAH 44 bn.

By the way, the NBU basically had no other choice but to turn on the mint. Furthermore, aside from commercial banks the central bank will also have to come to the rescue of the government, despite its independent status. Noteworthy, in the first half of this year the NBU transferred almost all of its annually planned deductions to the national budget from its earnings in the previous year.

Over 10 months the NBU contributed UAH 22.8 bn to cover the deficit of the national budget, though the revenues of the NBU in 2013 were only UAH 11.9 bn.

Accordingly, the central bank was forced to print additional money. “The budget is short of UAH 20-30 bn, not factoring in the initially planned deficit. This money can only come from additional active emission,” analysts of CASE Ukraine wrote in their report. They reminded that in the current condition printing of the national currency is extremely dangerous and could easily lead to the next wave of its devaluation.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.