Economy

turnaroundShopping malls are deferring their commissioning

The Arricano development company will open the Prospekt shopping mall on the left bank of Kyiv in early September, according to the acting general director of the company Yarema Kovaliv. The total area of the mall, construction of which started in 2012 – is 44,100 sq. m. “The Auchan chain is one of our partners in this project – so it financed construction of the supermarket,” said Kovaliv.

The Multiplex movie theater, McDonald’s, Foxtrot, Sportmaster, Mango and LPP group (Reserved, Mohito, Cropp Town, House, Sinsay) will be the mall’s anchor tenants. Prospekt will also have a parking lot for 1,300 vehicles. Kovaliv added that the amount of money invested in the opening of the shopping mall was close to US $80 mn and the expected return on investment is approximately 7 years.

Paltry offer

Prospekt is the second shopping mall to be commissioned this year. Atmosfera was the first one (leasable area of 30,200 sq. m), says Manager of the Shopping Space Department at JLL in Ukraine Anna Chubotina. Thus, only 70,700 sq. m of shopping space will be commissioned this year, which is 37% less compared to the previous year and almost by six times less than it was planned for 2014. As a reminder, this year a new record for the number of new retail spaces was expected.

Opening of the capital's largest shopping mall Respublika (leasable area of 135,000 sq. m, associated with business owner Dmytro Firtash) scheduled for this November was postponed to March 2015.

Developer Vagif Aliyev also plans to commission another two major shopping malls – Blockbuster Mall (124,000 sq. m) and Lavina Mall (124,000 sq. m) – next year, said First Vice Chairman of Mandarin Plaza (controlled by Aliyev) Oleksandr Chernytskiy. The future of Happy Mall (42,000 sq. m) does not seem to be promising: the Liko-Holding development company discontinued construction of this facility and is now reviewing its design concept.

Tenants play it safe

Problems with financing and optimization of retailers’ business are the main reasons for the deferral of construction deadlines. “Respublika will be finished by the end of this year, but we will not be able to find enough tenants. Nobody wants to commission the project with empty spaces,” a former employee of the project investor the Megapoliszhytlobud company told Capital on condition of anonymity. Indirectly, the founder of K.A.N. Development (Respublika’s developer) Ihor Nikonov confirmed it, saying that certain tenants attribute the current situation on the market to the force majeure circumstances.

As it was previously reported by Capital, the international chains suspended implementation of development plans until this fall, waiting for stabilization of the hryvnia exchange rate and an end to the hostilities in eastern Ukraine. Local players working with major international brands as franchises are simply trying to salvage their businesses. “It is clear that most chains have focused not on development, but primarily on optimization of their existing business,” says Director of the Retail Property Department at Colliers International (Ukraine) Natalia Kravets. The reason for this is a 30 – 50% drop in sales over January – June 2014 compared to the same period last year.

For example, Director for Business Development at Intermoda-Trade (In Wear/Matinique, Naf-Naf, Minelli, Marela, Laurel, Claire's, Inter-moda Trade chains) Myroslava Poshtak said, this year the retailer had to close the Minelli chain of shoe stores (approximately 10 outlets) as a part of their optimization program. “The current situation is difficult and we are forced to cut the number of unprofitable stores,” she says. Earlier, Capital wrote that one of the largest Ukrainian fashion-retailers Helen Marlen Group reduced the number of its outlets by almost 25% in favor of Internet sales. The Gap and Marks & Spencer also shut down their flagship stores in Ukraine.

Contrary to previously announced plans such international chains as Decathlon (sportswear), H&M (clothing), Body Shop (cosmetics) delayed their entry to the Ukrainian market for at least a year. It is also difficult to develop restaurant business. Since the beginning of the year close to 50 establishments went belly up in Kyiv (now there are 1,600 of them in the nation’s capital), reported Olha Nasonova’s Restaurant Consulting. This is due to the 15 – 20% decline in attendance in January – May compared to the same period last year. As a result, the vacancy rate in shopping centers in Q1 2014 in Kyiv was 6.3%, which is 2.1 times higher than in the same period last year, says Chubotina.

No other choice

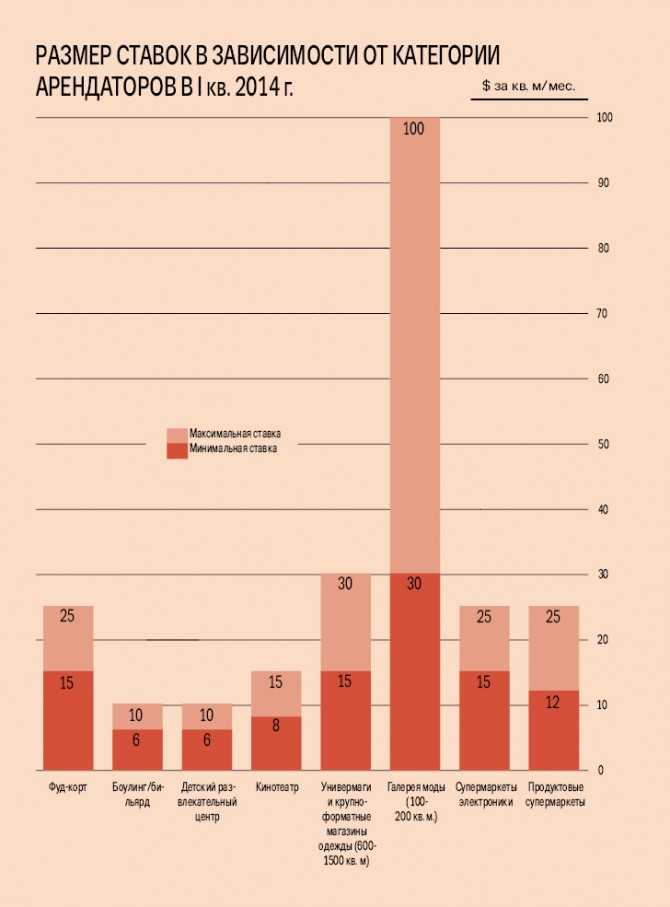

On the backdrop of the exchange rate swings and declining demand potential tenants are no longer interested in expensive shopping malls. Poshtak says Intermoda-Trade has not signed a lease with the Respublika shopping and entertainment center. “We are not satisfied with the terms of the agreement and the high rental rate,” she explains.

Now retailers are asking the owners of shopping malls to revise previously signed lease agreements, demanding a reduction of rates or their pegging to turnover and negotiaterent-free periods. They even go on a strike when the owners refuse to make any concessions.

As it was previously reported by Capital, 30 of 160 leaseholders at the Gulliver shopping mall protested in April demanding to reduce the rate by 50% or grant a rent-free period. Many retailers simply closed their stores without any unnecessary hullaballoo. As a result, the owners of shopping malls have heard them out and made concessions. “I closed the store in Ocean Plaza and then they called me and offered a 30% discount on the rent. But I am not interested anymore,” says the owner of a chain of pastry shops, who requested anonymity.

Shopping malls often fix the rent tied to the foreign currency at the rate of UAH 8 – 9.5 /US $, says Director of the Strategic Consulting Department at UTG Viktor Oborskiy. “Such rate is fixed for four to six months,” he adds. Sometimes tenants are offered discounts up to 50% of the agreed rate, according to the expert.

Rates will drop

Due to the introduction of new offers combined with the low demand, the number of vacant spaces in shopping malls will increase by the end of 2014, predicts Chubotina. She says the vacancy rate reached 8% at the start of May, according to preliminary estimates after opening of Atmosfera. Earlier, former Deputy Director of the Commercial Real Estate Department at the CBRE consulting company Vadym Zinchenko predicted that the increase in supply will lead to a drop in leasing rates by 30%. A director of leasing at one shopping mall in Kyiv said on condition of anonymity that they have been actively approached by tenants from Donetsk and Luhansk. “They are forced to leave those cities and are looking for spaces for their stores in Kyiv,” he says. Due to this factor, such leaseholders of shopping malls may reduce their vacancy rates in the coming months.

Opinions

It is hard for brands to find partners in Ukraine

Ilya Sazhin, Commercial Director at Immochan Ukraine (Auchan group)

Ilya Sazhin, Commercial Director at Immochan Ukraine (Auchan group)

Making a decision to enter a new market operators pay great attention to national factors (the political situation, administrative and legal systems, etc.), as well as many others, including purchasing power, the mentality of the consumer, availability of quality retail spaces that correspond to the formats of their brands, the competitiveness of their price range, etc.

Prior to entering the Ukrainian market foreign retailers analyze it in detail together with international or local research companies. They conduct an in-depth analysis of the people’s purchasing power, develop images of future customers, examine the willingness of consumers to buy certain products, evaluate the formats of shopping malls to ensure that they meet the requirements for the placement of their brands and rental rates in spaces where expansion is planned.

There are two ways for a brand to enter a market: direct and through signing a franchise agreement or a partnership agreement. The search for development partners is the main problem for major brands on the Ukrainian market.

We have been trying to find potential partners for brands belonging to our group for quite some time, but this is not an easy task. Notwithstanding, this is quite possible provided there are positive trends in the economy and the real estate market in particular. Also, commissioning of new large retail properties in Kyiv and the regions will be a plus, because for chain operators it is essential to have multiple sites for their stores in order to optimize the companies’ expenses on offices, logistics, etc.

Retail property is attractive

.jpg) Dmytro Sennichenko,

Dmytro Sennichenko,

Head of the JLL Office in Ukraine

The retail property market in Ukraine has all the preconditions to attract potential investors. Compared to other European cities, the retail market in Kyiv and other Ukrainian cities is not saturated. Thus, based on the results of the Q1 2014 the area of retail spaces in the capital was 257 sq. m per 1,000 residents, which is 26% lower than in Berlin and at least 2.5 times lower than in Warsaw and Prague. The market saturation index in large regional cities over the past year has ranged from 87 sq. m per 1,000 residents in Lviv to 242 sq. m per 1,000 residents in Dnipropetrovsk. In addition, the vacancy rate in most shopping malls in Ukraine has remained at the same level over the past four years (close to 3 4%). All this, along with higher returns than on European markets, makes retail property in Ukraine extremely attractive for potential investors.

At the same time, absence of deals based on the results of 2013 suggests there are problems on the market, which scared off many investors. In addition to macroeconomic imbalances, the main external factors and constraining activities were corruption, omissions in the law and the judicial system, which could not protect investors’ interests. After signing the Association Agreement with the European Union and implementation of quality changes in the aforementioned areas, we can expect a return of foreign capital not only in commissioned facilities, but also in quality projects, because Ukraine’s huge potential for development and benefits from the growing market will always be of interest. We just need to do the “homework”.

Chains and networks will be the first to take the blow

.jpg) Yulia Selivanovska,

Yulia Selivanovska,

Development Manager at Mango in Ukraine and CIS countries

Relations between retailers and owners of shopping malls are exceptionally positive, which is quite pleasing. The considerable influence of the European experience of representatives of foreign development companies to Ukraine is gradually being adopted by local companies. It includes negotiation, selection of tenants in shopping malls and drafting of lease contracts acceptable to both parties.

To attract or retain quality tenants owners of shopping malls are increasingly making temporary concessions in leasing. There is more understanding that the unstable economy in Ukraine in times of crisis first and foremost affects retailers. And turning a blind eye can result in losing a potential lessee. Developers have gained such experience on the local market on their own, as there are very few such examples in Europe.

Still, many problems remain unresolved in reference to the terms of lease proposed by the owners. It is traditional for Ukraine: tenants have to pay a lot in order that projects see a quick return on investments.

Ukrainian shopping mall owners are applying the practice of European shopping malls with their low rental rates and interests from turnover only partially. They began charging interest on turnover, but did not lower their rates. This gave owners only additional benefits.

Negotiations with leaseholders

.jpg) Aleksandr Melamud,

Aleksandr Melamud,

Co-owner of the Dream Town Shopping mall

There is no single recipe to help lessees: we negotiate with each and every one of them individually. We need to understand the specific situation with every particular store. Roughly speaking, we try to put our feet in their shoes. To understand this, it is enough to know how things are going with sales for at least one outlet similar in range and size.

In fairness it should be noted that all our tenants currently have a common problem – namely, a sharp drop in sales. In general, sales volumes were halved in June compared with the same month last year: restaurants registered higher drop in sales than fashion boutiques and clothing stores. There is an interesting situation with our indoor water park. In June, we recorded a slight increase in its sales turnover in the hryvnia equivalent compared to the corresponding period last year. In my opinion, this is due to the cool weather at the beginning of summer in Ukraine and the fact that the number of people who went on vacation was comparatively lower than in previous years.

Despite the complex situation with sales, there are companies wishing to open stores in our mall. Nevertheless, negotiations with retailers are not easy. Many chains would like to sign long-term leases expecting to “lock” current low rental rates, but this is not profitable for the shopping malls. Short-term agreements, for example, for six months are not profitable for such chains. They invest into renovation of premises and want to see a quick return on their investments. In short, there is no single recipe for resolving such a conflict of interests. We try to find a compromise in every particular case.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.