Economy

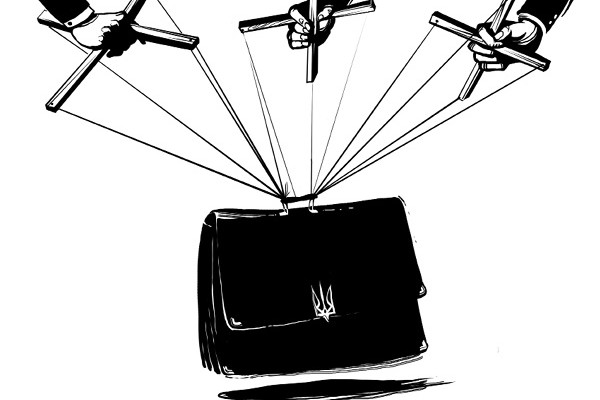

taxesThe proposal of the Ministry of Economic Development on modifying the tax system did not get the necessary support

A number of ministries failed to reach a consensus on their positions regarding the proposals of the concept for reform of the tax system. At the recent meeting of the working group under the aegis of the Ministry of Economic Development and Trade, representatives of the Ministry of Finance, the Ministry of Revenue and Duties and the Ministry of Social Policy expressed different visions of the further development of tax legislation.

According to information that Capital possesses, discussions were held on the issue of lowering the VAT and cutting the number of taxes planned by the government within the framework of the tax reform.

Controversial proposals

The lowering of the VAT by 7% for settlements between payers and 17% for non-payers is proposed in the document drafted by the working group of the Ministry of Economic Development and Trade, which Capital has a copy of. “The decrease in tax proceeds from settlements with payers will be compensated by the increase in tax proceeds from the VAT upon the sale of goods and services to non-payers,” believes the head of the working group and Vice President of the Ukrainian Union of Industrialists and Entrepreneurs Valeriy Pekar. In his opinion, the proposed scenarios would allow for liquidation of certain illegal schemes in overcharging of VAT. As such, at a rate of 7% formation of a fictitious tax credit is unprofitable and given the difference of rates of 7% and 17% it will be impossible to form its sufficient volume, the expert noted.

Besides the introduction of a differential VAT rate over the last month of its revision, a chapter appeared in the document on which taxes should be abolished in the opinion of the Ministry of Economic Development and Trade. The matter is about 9 taxes that in total generate 2% of revenues to the national budget, though they require separate administration: tourism, first registration of a vehicle, parking, use of radio frequencies and development of the winery industry, horticulture and hops growing. Taxes on targeted mark-ups on tariffs for electricity and natural gas, on environmental pollutions and running certain types of entrepreneurial activities are also on the list of potential abrogation.

Compensating the shortage of proceeds due to the lowering of taxes is proposed at the expense of the extending the excise tax base to electricity and natural gas.

The ministry also proposes two measures within the framework of tax reform: cutting the rates of the unified social security tax (USST) from 36.77% to 18% for those taxpayers, which will double the payroll over a set period of time and uniting all funds of social security into one.

Counter argument

The Ministry of Finance and the Ministry of Social Policy accepted the initiatives of the Ministry of Economic Development and Trade with criticism. According to the estimates of the Ministry of Finance the introduction of a differential rate of the VAT will cost the national budget a shortage of UAH 33 bn in proceeds and in the case of optimization of the number of taxes and duties the treasury fall short of another UAH 1.1 bn. As a result, the total amount of proceeds to the budget will be reduced by 2.3% of GDP.

Minister of Finance Oleksandr Shlapak says such a scenario contradicts the Directive of the European Union, which envisages reducing the rate of the tax only for certain necessity goods and services. “On average the size of the main rate of the VAT in EU countries in 2014 is 21.5% and the VAT is lower than 20% for only five categories. An analysis of the VAT rate shows that the overwhelming majority of European counties did not change its size and some even raised it,” the minister noted.

In particular, the VAT rate was raised (on average by 2 percentage points) in the Czech Republic, Spain, Croatia, Cyprus, the Netherlands, Slovenia and Finland. In 2014 the VAT rate was reduced only in France to the level that was in effect in 2012 (from 20% to 19.6%).

As for reduction in the number of duties, “seeing that in some budgets revenues from them are considerable” the Ministry of Finance proposes to envisage compensators of expected shortages, for example, raising the excise tax on automobiles with the cancellation of the tax on first registration of a vehicle. Elimination of taxes for parking or conducting certain types of businesses could be formal in nature – they will simply be granted the status of payment for administrative services.

Minister of Social Policy Lyudmyla Denysova criticized the initiative of lowering the size of the USST, which puts under threat the financial stability of social security funds. “The shortage of proceeds from the single tax to the funds will run up a debt in the payout of material guarantees to the insured and will lead to a deficit of the budget funds and a reduction in the level of social guarantees of employees,” Denisova is convinced.

As a result, the Ministry of Finance proposed to the Ministry of Economic Development and Trade to place accents and focus on indirect taxes in the process of drafting the “roadmap” for the tax reform. For example, the focus should be on transferring the tax burden from labor and capital to resource and environmental payments and the further review of tax rates for the use of the bowels of the earth for those minerals, the proceeds from which are sufficiently low, while their extraction is quite profitable.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.