Finance

Public FinanceThe NBU supported the hryvnia with the IMF loan

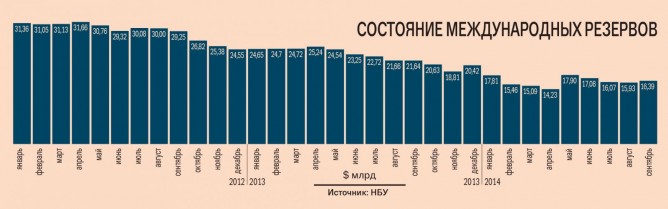

In September Ukraine’s international reserves increased by 2.8% to US $16.385 bn, according to yesterday’s report from the NBU. The gold and forex reserves of the country increased after several months of decline. This was mainly thanks to the second tranche (US $1.4 bn) within the framework of the stand-by arrangement of the International Monetary Fund, which Ukraine received in early September. US $978.42 mn of the aforementioned amount went directly to the state budget, while the remaining part was credited to the account of the NBU. Another US $602.85 mn came from loans of the World Bank and placement of government bonds. However, overall Ukraine’s international reserves have decreased by US $4.03 bn since the beginning of the year.

Hryvnia S.O.S.

Only a small amount of the western loans received in September remained in the foreign exchange reserves of the NBU. Last month, the government took US $313.95 mn to repay the public debt, of which US $193.12 mn was used to pay off the debt to the IMF. However, the lion's share of the amount allocated for the foreign exchange reserve was spent by the NBU on interventions. This is despite the fact that the government sold the NBU US $340 mn to replenish foreign exchange reserves to stabilize the exchange rate of the national currency.

In September, the NBU resumed the practice of currency auctions combined with the sale of dollars on the interbank foreign exchange market. In total, the NBU sold US $833.74 mn last month and bought only US $98.3 mn to replenish the foreign exchange reserves. In October, the NBU proceeded with the auctions. In less than a month it spent nearly US $800 mn for this purpose. The auctions did not help reduce the demand for dollars, though they partially satisfied the needs of the retail market. At least in Kyiv banks individuals can now buy currency at the official exchange rate, though in limited quantities.

So far, the NBU does not intend to slow down the volume of sales of dollars to banks for refilling the coffers in order to meet the needs of corporate clients. “Interventions or auctions in the current amounts are sufficient and adequate and we are able to maintain this rate of interventions for a certain period of time in order to settle the situation on the foreign currency exchange market,” said First Deputy Governor of the NBU Oleksandr Pisaruk.

Given the amount of the past interventions it is possible to assume that by the end of October gold and forex reserves will be considerably reduced. Also, on October 1 the NBU sold Naftogaz US $1.67 bn to pay for Eurobonds and their interests. Consequently, in October the NBU’s currency expenditures will clearly exceed those in September.

Debt pit

The government also needs dollars to finance the budget and external obligations. “While the filling of the budget appears to be less critical, covering external obligations in conditions of declining reserves remains up in the air,” says Analyst at Morgan Stanley Alina Slyusarchuk. Among other things, according to the expert, by the end of the year there will be pressure on the gold and forex reserves due to the debt to Gazprom of more than US $3 bn and Russia’s determination to sell gas to Ukraine on pre-payment terms. The pressure on reserves is also due to the increased demand for currency on the eve of the parliamentary elections.

Based on the forecast of analysts at the Institute for Economic Research and Policy Consulting, if the IMF stand-by arrangement is extended in 2015, Ukraine will be able to increase international reserves by almost US $10 bn. The costs will be comparable as in 2015 the country is obligated to pay back more than US $9 mn under foreign commitments, including US $3 bn owed to Russia for the issue of bonds at the end of 2013.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.