Finance

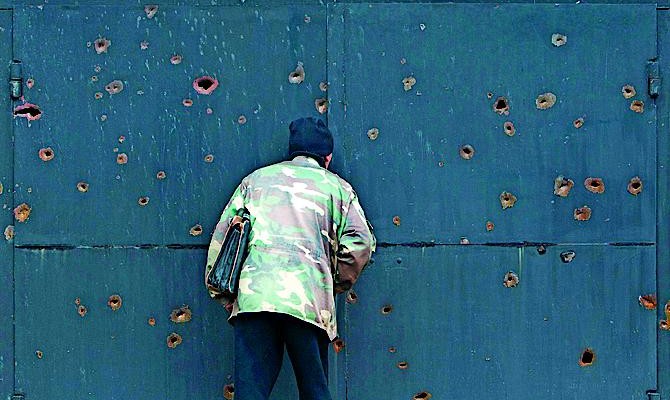

banksAccess to bank accounts to be restricted for residents of the ATO zone

In a month bank account services for individuals and legal entities will be suspended. President Petro Poroshenko submitted the corresponding instruction to the National Bank of Ukraine. The decree of the head of state reads, “The National Bank of Ukraine must take measures to prohibit commercial banks from servicing standard and ATM accounts opened by businesses of all forms of ownership and people living on the territory, where anti-terrorist operation is being conducted in the Luhansk and Donetsk oblasts within one month.”

Stopping the leak

The president’s decision will seriously complicate the operations of businesses and the lives of the local population. However, experts that Capital surveyed said this move is justified in the interests of the central government. “This is an absolutely correct decision that will block the banking system from cashing in or transferring money to separatists from beyond the borders of the country to the territories that are not controlled by ATO forces,” Chairman of the Board of the Ukrainian Interbank Currency Exchange Anatoliy Hulei pointed out. At the same time, the expert is surprised that this decision was made only now and not back in August-September.

The latest high-profile scandal around the cooperation of banks with separatists was the accusation that the state-run Oschadbank and some of its branches continued their operations in the zone that is not controlled by the central government.

Oschadbank admitted that some of its branches in Donetsk worked on an abridged regime “to fulfill their social functions”, but nevertheless denied that they had anything to do with financing terrorists. The bank interprets the spread of such information as the activity aimed at undermining the Ukrainian financial system.

Financial analyst Pavlo Mishustin approves the decision of the government, explaining that the re-registration of legal entities in the ATO zone is one method of financial fraud and dodging certain obligations, for example to banks and the state budget. Now, pulling off such a scheme will be more difficult without access to the banking system.

However, matters will be more difficult not only for regular clients, but also for banks. Indeed, regional banks and those actively working with the corporate sector will be the first to sustain losses from this situation. After all, most of the largest industrial enterprises that take out bank loans operate in the eastern part of Ukraine. For example, 30% of the business clients of PUMB (First Ukrainian International Bank) live in the ATO zone. Banks that actively work with average citizens, such as Oschadbank and PrivatBank, will also sustain losses as the eastern oblasts of Ukraine are among the most densely populated.

At the end of October, Minister of Finance Oleksandr Shlapak informed that the losses of Ukrainian banks in the ATO zone were UAH 60 bn. The banks appealed to the NBU requesting that such losses be written off as expenses gradually, not immediately.

Self-employed

Meanwhile, individuals and legal entities registered on the territory of the self-proclaimed Donetsk People’s Republic may be transferred to services in the recently created Central Republican Bank of the DPR. As Capital wrote earlier, according to the resolution of the Ministry of Finance of the DPR this financial institution should become the central bank of the republic. The procedure for opening accounts in the bank began on October 13. According to information of militants, an internal system of payments was created prior to that date.

By the way, there are no guarantees that residents in the ATO zone will be granted any access to banking services. From a legal standpoint, the law on the special status of the territory controlled by militants that was adopted by the Verkhovna Rada does not give them the right to create its own bank. “Self-administration in the regions does not mean that they can regulate issues of monetary turnover and financial-credit relations,” says partner of the Ilyashev and Partners law firm Maksym Kopeichykov. “Self-administration is expanded within concisely specified limits and the right to issue one’s own currency or organize a central bank is not envisaged in the law, which means that it is against the law.”

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.