Finance

refinancingNBU increases the issuance of refinancing loans for commercial banks

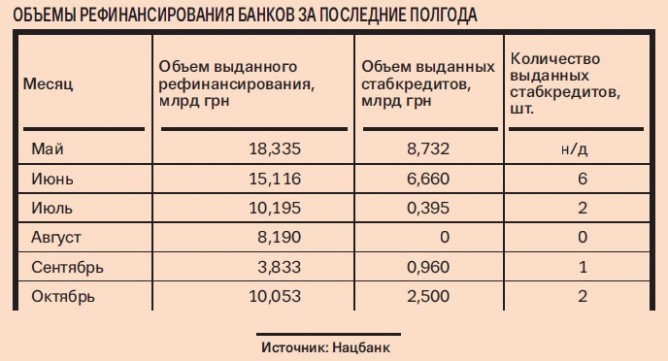

In October, the total volume of refinancing issued by the National Bank of Ukraine exceeded UAH 10 bn, which is UAH 6.2 bn more than in the previous month. In November, this amount will be increased.

Changing the order of addends does not change the sum

The situation in the Ukrainian banking system remains tense, liquidity is distributed unevenly and many financial institutions are experiencing a deficit, says Advisor to Chairman of Eurobank Vasyl Nevmerzhytskiy. The outflow of individuals’ deposits from the system persists and the growth of deposits of legal entities cannot compensate it in full. Since the beginning of the year, the hryvnia deposit portfolio has decreased by UAH 53.2 bn and the hard currency portfolio – by US $7 bn. “The NBU is ready to support those financial institutions engaged in classical banking. And, of course, the regulator will support the largest financial institutions, because their stability largely determines the stability of the entire banking system,” says Nevmerzhytskiy. In the above context, the banker does not rule out that the state may even enter into the capital of one of the largest banks.

According to the NBU, in addition to conventional refinancing, the regulator issued in October two stabilization loans to the tune of UAH 2.5 bn.

As NBU Governor Valeriya Hontareva stated earlier, one loan was issued in the amount of UAH 1.3 bn and a second bank received UAH 1.2 bn. “I think we are talking about banks of the first or second category. The size of the loan is quite substantial,” says Nevmerzhytskiy. The NBU did not disclose any information about the borrowers. Nadra Bank definitely needs support, since as of October 1 its liquidity ratio was 20.87%, whereas the required minimum is 40%.

Previously, such loans were issued to the Privat Bank and Delta Bank. At the same time, there is little evidence that the stabilization loan helped Delta Bank handle the outflow of deposits. The financial institution has a cash withdrawal limit for its customers of UAH 1,000 per day. Neither the bank, nor the NBU commented on the situation with unauthorized limits of Delta Bank.

Support the weak

This month, commercial banks were even more active in taking money from the NBU. As of November 14, the volumes of refinancing issued to the banks are twice the amount provided in October amounting to UAH 15.6 bn.

“Because of the decision of the National Security and Defense Council approved by instruction of the president of Ukraine to freeze bank accounts of business entities in some territories in the ATO zone within this month, it is can be said that the banks in which such clients had their accounts will sustain additional losses, which will have a negative impact on liquidity,” predicts Director of the Department of Financial Ratings at IBI-Rating Anna Apostolova. The first to sustain losses from termination of maintenance of accounts will be regional banks and banks actively working with the corporate sector, because the majority of large industrial borrowers are located in the eastern part of the country. Also, financial institutions actively working with average citizens will also sustain serious losses, for example Oschadbank and Privat Bank, seeing as the eastern region of the country is one of the most densely populated.

“The country’s banking system will most definitely need assistance from the state. I think the NBU will continue to provide refinancing to classic banks and will certainly not allow any serious troubles in the largest banks, even if it is forced to resort to recapitalization by the state,” says Nevmerzhytskiy.

Aiming at withdrawal

In this case, the NBU not only provides refinancing, but also absorbs liquidity by selling certificates of deposit (CODs) to commercial banks. During the last month, banks bought CODs from the NBU to the tune of approximately UAH 125.6 bn. Such a large amount can be explained by the fact that short-term “overnight” CODs are in greatest demand. Every day 12–24 banking institutions purchased such certificates. The NBU governor earlier noted that the amounts of hryvnia withdrawn from financial institutions exceeded the amount of refinancing issued to banks by several billions.

The overbalance of the volumes of mobilization of hryvnia funds over the volumes of refinancing has been the trend of recent months, says Apostolova. “Over a long period of time lending opportunities for many banks have been significantly limited. This is due to the deterioration of the financial status of current and potential customers on the backdrop of the economic downturn and, consequently, the growth of credit risk. For the same reasons investment in securities other than T-bills has significantly declined. In addition to that, the deterioration of liquidity indices for some institutions contributed to closure of a number of interbank limits for counter-party banks,” Apostolova stressed. In such circumstances, the NBU’s certificates of deposit are the most attractive investment instrument, because, in fact, banks have nothing else to invest in.

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked

of the agreement of syndication with Financial Times Limited are strictly prohibited. Use of materials which refers to France-Presse, Reuters, Interfax-Ukraine, Ukrainian News, UNIAN agencies is strictly prohibited. Materials marked  are published as advertisements.

are published as advertisements.